GET FREEDOM FROM DEBT

Personal Loan Settlement Struggling with personal loan EMIs? Facing constant recovery calls from banks or NBFCs? You're not alone. Thousands of borrowers across India seek personal loan settlement as a viable solution to break free from overwhelming debt. At TrueSettle, we specialize in helping individuals negotiate favorable settlement terms with creditors, offering you a legal pathway to financial relief.

We help you to settle your

What Is Personal Loan Settlement?

Personal loan settlement is a debt resolution strategy where you negotiate with your lender to repay a reduced amount—less than the total outstanding debt. This negotiated amount, known as the settlement sum, is typically paid either as a lump sum or through structured monthly payments.

Unlike regular loan repayment, settlement involves convincing your creditor to accept partial payment and close your loan account. Banks and NBFCs may agree to this arrangement when they believe recovering the reduced amount is more practical than pursuing the full debt through lengthy legal processes.

Key Point: Personal loan settlement is different from loan default. While default severely damages your credit profile, settlement is a negotiated agreement that can help you resolve debt while minimizing long-term financial damage.

Our Services

Loan Settlement

Helping individuals and businesses ethically resolve unsecured loan burdens through professional negotiation, legal guidance, and emotional support.

Is It Possible to Settle a Personal Loan?

Yes, personal loan settlement is entirely possible, and here’s why: personal loans are unsecured debts, meaning they’re not backed by collateral like property or vehicles. This lack of security gives borrowers more negotiating power with lenders.

Why Personal Loans Can Be Settled:

- No collateral for banks to seize

- High cost of recovery for lenders through legal channels

- Banks prefer recovering partial amounts over complete write-offs

- Regulatory pressure on banks to resolve NPAs (Non-Performing Assets)

Unlike secured loans or co-signed student loans, personal loans offer greater flexibility for negotiation. When faced with genuine financial hardship, most banks and NBFCs are willing to discuss settlement options rather than escalate to legal action.

When Should You Consider Personal Loan Settlement?

Personal loan settlement isn’t for everyone. It’s a solution designed for borrowers facing genuine financial distress. Consider this option if you’re experiencing:

Valid Scenarios for Settlement:

- Job Loss or Income Reduction: Sudden unemployment or significant salary cuts making EMI payments impossible

- Medical Emergencies: Unexpected healthcare expenses draining your finances

- Business Failure: Loss of income from failed business ventures

- Multiple Debt Burden: Juggling several loans with unmanageable combined EMIs

- Family Crisis: Major family responsibilities affecting your ability to repay

Warning Signs You Need Help:

- Missing EMI payments for 3+ consecutive months

- Using one loan to pay another (debt cycling)

- Receiving daily recovery calls from multiple lenders

- Facing threats of legal action or CIBIL damage

- Experiencing severe mental stress due to debt

Our Services

Loan Settlement

Helping individuals and businesses ethically resolve unsecured loan burdens through professional negotiation, legal guidance, and emotional support.

What to Do If You Cannot Pay Monthly EMIs?

If you’re unable to meet your monthly repayment obligations, taking immediate action is crucial. Here’s what you should do:

Step 1: Assess Your Financial Situation

Calculate your total income, essential expenses, and outstanding debts. This honest evaluation helps you understand the severity of your situation.

Step 2: Contact Your Lender Immediately

Don’t avoid your bank’s calls. Proactive communication shows good faith and may lead to temporary relief options like:

- EMI moratorium or payment holidays

- Loan tenure extension to reduce monthly EMI

- Interest rate restructuring

Step 3: Document Your Hardship

Gather proof of your financial distress—termination letters, medical bills, business closure documents—to strengthen your negotiation position.

Step 4: Explore Settlement Options

If restructuring doesn’t help, it’s time to consider formal settlement negotiations. This is where professional assistance from companies like TrueSettle becomes invaluable.

Important: Never ignore lender communication or stop payments without attempting negotiation. This can lead to immediate legal action and severe credit damage.

Ways to Settle a Personal Loan

When negotiating with your lender, you’ll encounter two primary settlement methods. Each has distinct advantages depending on your financial capacity:

1. Lump-Sum Settlement

A one-time payment of the negotiated settlement amount, typically ranging from 40-70% of your outstanding debt.

Advantages:

- Higher discount from lenders (potentially 30-60% off)

- Quick resolution—account closed within days

- Stops recovery harassment immediately

- Lesser negative impact on credit score compared to prolonged defaults

Best For: Borrowers who have access to a significant amount (through savings, family support, or asset liquidation) but cannot sustain monthly payments.

2. Monthly Payment Settlement

Structured repayment of the settlement amount over an agreed period (typically 6-24 months).

Advantages:

- Smaller, more manageable monthly payments

- No need for large upfront capital

- Gradual debt elimination

- Flexibility for cash-flow constrained borrowers

Best For: Those with stable but reduced income who can commit to smaller monthly obligations.

Lump-Sum vs Monthly Settlement: Which Is Better?

The right choice depends entirely on your financial situation:

Choose Lump-Sum Settlement If:

- You have access to a significant amount through savings or support

- You want the fastest resolution with maximum discount

- You’re facing imminent legal action

- You want to minimize credit score damage

Choose Monthly Payment Settlement If:

- You lack substantial upfront capital

- Your income is stable but insufficient for lump sum

- You can commit to regular monthly payments

- You need extended time to clear the debt

TrueSettle’s Expert Tip: Lenders generally prefer lump-sum settlements and offer better discounts for this option. However, the best choice is one you can realistically fulfill without defaulting again.

How to Negotiate a Personal Loan Settlement

Successful settlement negotiation requires strategy, preparation, and persistence. Follow these proven steps:

1. Stop Payments Strategically

While controversial, stopping EMI payments (typically for 90-120 days) demonstrates genuine financial distress to lenders, making them more receptive to settlement discussions.

2. Document Your Financial Hardship

Compile evidence: salary slips showing reduced income, termination letters, medical bills, or business loss statements. Credible documentation strengthens your case.

3. Initiate Formal Communication

Send a written settlement proposal to your bank’s recovery or collections department. Include your hardship details and proposed settlement amount.

4. Start Low, Negotiate Up

Begin negotiations at 30-40% of outstanding debt. Banks typically settle between 40-70%, so starting low gives you negotiating room.

5. Get Everything in Writing

Never make settlement payments without a written agreement specifying:

- Exact settlement amount

- Payment deadline

- Confirmation that account will be closed

- “Settled” status on your credit report

6. Make Payment Through Proper Channels

Always use bank transfers or demand drafts for traceability. Never pay in cash.

7. Obtain Closure Documents

After payment, ensure you receive:

- No Due Certificate (NDC)

- Formal closure letter

- Written confirmation to credit bureaus

Why Professional Help Matters: Negotiating with banks requires knowledge of banking regulations, settlement precedents, and effective communication strategies. TrueSettle’s experts handle these negotiations daily, achieving better discounts and favorable terms that individual borrowers typically cannot secure.

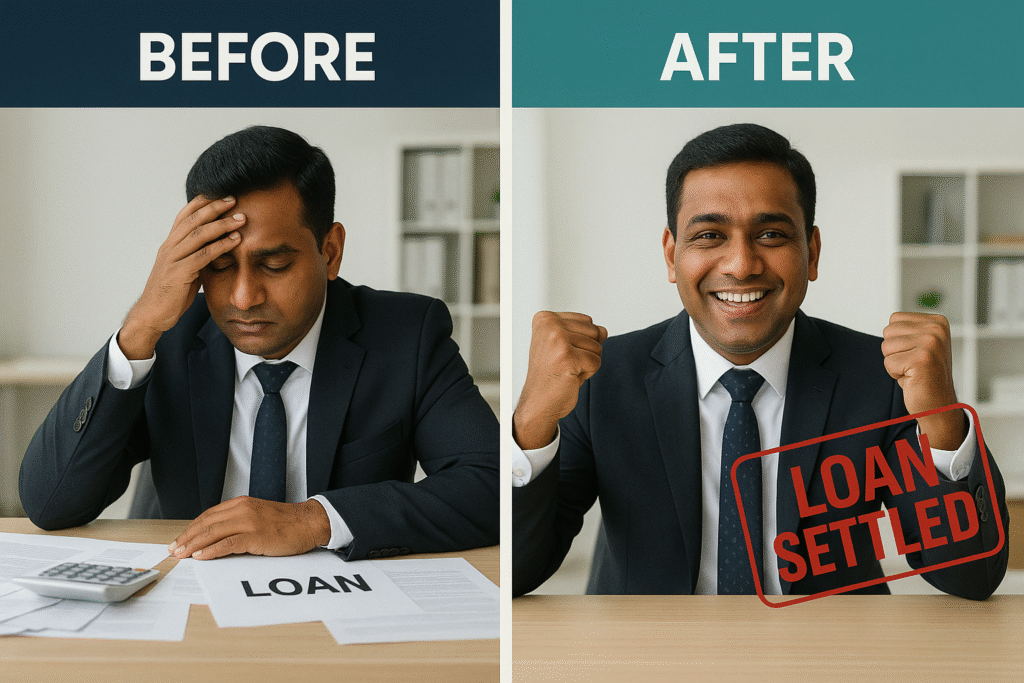

Benefits of Personal Loan Settlement

Choosing loan settlement through TrueSettle offers multiple advantages:

1. Significant Debt Reduction

Settle your loan for 40-70% of the outstanding amount, saving thousands in the process.

2. Stop Recovery Harassment

End the constant calls, messages, and visits from recovery agents once the settlement is formalized.

3. Avoid Legal Complications

Prevent potential legal suits, court summons, or asset attachment proceedings by resolving debt proactively.

4. Financial Breathing Room

Free up your monthly cash flow for essential expenses rather than unmanageable EMIs.

5. Faster Debt Resolution

Close your loan account in 90-180 days instead of remaining in debt for years.

6. Mental Peace

Eliminate the stress, anxiety, and sleepless nights caused by overwhelming debt.

7. Credit Rebuilding Opportunity

While settlement impacts your credit score, it’s better than prolonged defaults or write-offs. You can rebuild your credit after settlement.

Impact of Settlement on Credit Score

Let’s address the elephant in the room: yes, personal loan settlement does impact your credit score, but understanding how helps you make an informed decision.

Credit Score Reality:

- Settlement Status: Your account will be marked “Settled” on your CIBIL report

- Score Drop: Expect a temporary decrease of 50-100 points

- Duration: The settled status remains on your report for 7 years

- Future Lending: Some lenders may be hesitant initially, but not all

Settlement vs Default: The Important Difference

| Aspect | Settlement | Default/Write-off |

|---|---|---|

| Credit Report Status | “Settled” | “Written Off” |

| Score Impact | Moderate (50-100 points) | Severe (150-250 points) |

| Lender Perception | Resolved debt | Abandoned debt |

| Recovery Calls | Stop after settlement | Continue indefinitely |

| Legal Risk | Minimal after settlement | High risk of litigation |

| Future Borrowing | Possible after 12-24 months | Extremely difficult |

Credit Rebuilding After Settlement:

- Settle all outstanding debts

- Maintain good credit behavior on any remaining accounts

- Use secured credit cards to rebuild credit history

- Make timely payments on all future obligations

- Your score can recover significantly within 18-24 months

TrueSettle’s Perspective: While settlement does affect credit, it’s a controlled, temporary impact that’s far better than the permanent damage of defaults, legal judgments, or write-offs. We help you understand these implications and plan your financial recovery strategically.

Should You Take Help from a Loan Settlement Company?

Navigating loan settlement alone can be overwhelming, especially when dealing with aggressive recovery departments and complex banking procedures. Here’s why professional assistance makes sense:

What TrueSettle Brings to Your Settlement Journey:

1. Expert Negotiation Skills

Our team understands banking psychology, regulatory frameworks, and negotiation tactics that secure maximum discounts. We’ve successfully settled thousands of loans across major banks and NBFCs.

2. Legal Protection

We ensure your rights are protected throughout the process, preventing unfair recovery practices or coercive tactics by lenders.

3. Documentation Expertise

We handle all paperwork, ensuring agreements are legally sound and protect your interests.

4. Better Settlement Rates

Our established relationships with banks and proven track record often result in 10-20% better settlement terms than individual negotiations.

5. Shield from Recovery Harassment

Once you engage TrueSettle, we become your point of contact, shielding you from aggressive recovery calls and visits.

6. Transparent Process

We maintain complete transparency about fees, timelines, and realistic settlement expectations—no hidden charges or false promises.

7. Post-Settlement Support

Our service doesn’t end with settlement. We ensure proper closure documentation and guide you on credit rebuilding.

When to Seek Professional Help:

- You’re unfamiliar with banking procedures and legal rights

- Previous negotiation attempts have failed

- You’re facing multiple loan settlements simultaneously

- Recovery harassment has become unbearable

- You want to maximize your settlement discount

- You need protection from unfair recovery practices

Investment vs Savings: While professional services involve fees, the settlement discounts secured often far exceed these costs. More importantly, you gain peace of mind, legal protection, and significantly higher success rates.

Next Steps to Settle Your Personal Loan

Ready to take control of your debt situation? Here’s your roadmap to financial relief with TrueSettle:

Step 1: Free Consultation (15 Minutes)

Schedule a no-obligation consultation with our debt settlement experts. We’ll assess your situation, loan details, and settlement potential.

Step 2: Customized Settlement Strategy

Based on your financial position, we’ll design a tailored settlement plan—whether lump-sum or monthly payment settlement—that aligns with your capacity.

Step 3: Formal Engagement

Once you’re comfortable with our approach, we formalize our engagement with a transparent agreement outlining services, fees, and expected timelines.

Step 4: Negotiation Phase (30-90 Days)

Our experts initiate negotiations with your lenders, presenting your case for settlement while protecting you from recovery harassment.

Step 5: Settlement Agreement

Once we secure favorable terms, we ensure all agreements are properly documented and legally sound before any payment is made.

Step 6: Payment & Closure

You make the settlement payment through proper banking channels, and we ensure complete closure documentation—No Due Certificate, closure letters, and credit bureau updates.

Step 7: Post-Settlement Support

We provide guidance on credit rebuilding and remain available for any post-settlement queries.

Timeline: Most personal loan settlements are completed within 90-150 days, though complex cases may take longer.

Take the First Step Toward Financial Freedom

Living under the constant stress of unmanageable debt affects every aspect of your life—your health, relationships, and peace of mind. You don’t have to face this alone.

At TrueSettle, we’ve helped thousands of borrowers across India negotiate fair settlements with banks and NBFCs, achieving significant debt reductions while protecting their legal rights. Our expertise in personal loan settlement, combined with our commitment to transparent, ethical practices, makes us the trusted partner in your journey to financial recovery.

Why Choose TrueSettle? ✓ Proven track record with major banks and NBFCs

✓ Legal expertise in debt settlement regulations

✓ Maximum settlement discounts (40-70% debt reduction)

✓ Complete protection from recovery harassment

✓ Transparent fees with no hidden charges

✓ Post-settlement credit rebuilding guidance

Don’t let debt control your life any longer. Contact TrueSettle today for a free, confidential consultation and discover how much you could save through professional loan settlement services.

📞 Call us now: +91 8588808825

💬 WhatsApp: +91 8588808825

📧 Email: info@truesettle.in

Your path to debt freedom starts with one conversation. Let’s begin today.

Frequently Asked Questions (FAQs)

Q: Can personal loans be settled legally in India?

Yes, personal loan settlement is completely legal in India. It’s a negotiated agreement between you and your lender to resolve debt. However, it must be done through proper documentation and legitimate channels.

Q: How much discount is possible in personal loan settlement?

Settlement discounts typically range from 30-60% of your outstanding debt. The exact amount depends on factors like your financial hardship, loan default duration, lender policies, and negotiation skills. With TrueSettle’s expertise, clients often achieve settlements between 40-70% of the original debt.

Q: Does settlement stop recovery calls and harassment?

Yes, once a settlement agreement is signed and payment is made, all recovery calls and harassment must stop legally. TrueSettle ensures proper documentation that protects you from any further recovery actions.

Q: How long does personal loan settlement take?

The typical settlement timeline is 90-150 days from initiating negotiations to final closure. This includes negotiation periods, documentation, payment, and obtaining closure certificates. Complex cases involving multiple loans may take longer.

Q: Will settlement affect my ability to get loans in the future?

Settlement does impact your credit score and appears on your report for 7 years. However, it’s significantly better than default or write-off status. Many lenders may approve loans after 1-2 years of settlement, especially if you demonstrate improved financial behavior. TrueSettle provides credit rebuilding guidance post-settlement.

Q: What documents do I need for loan settlement?

Essential documents include: loan account statements, identity proof (Aadhaar, PAN), income proof (salary slips, bank statements), and hardship documentation (termination letter, medical bills, business closure proof). TrueSettle guides you through the complete documentation process.

Q: Can I settle multiple personal loans simultaneously?

Yes, multiple loan settlements can be managed simultaneously. In fact, consolidating settlements often provides better negotiating leverage. TrueSettle specializes in handling multiple loan settlements efficiently.

Q: Is it better to settle or declare bankruptcy?

Personal bankruptcy (insolvency) is a lengthy legal process with severe long-term consequences. Loan settlement is typically faster, less damaging to your credit, and doesn’t carry the social stigma of bankruptcy. TrueSettle helps you explore all options and choose the best path forward.

Testimonial

Voices of Trust