Why Choose Us

Real expertise. Real results. TRUESETTLE

Empowers you to settle debt and stop harassment — the right way.

Our team engages with creditors directly, so you don’t have to deal with repeated calls

Our settlement process follows RBI guidelines, ensuring transparency and legal compliance.

You stay informed at every stage with timely updates—no confusion, no guesswork.

With legal closure and structured resolution, your credit profile can improve over time.

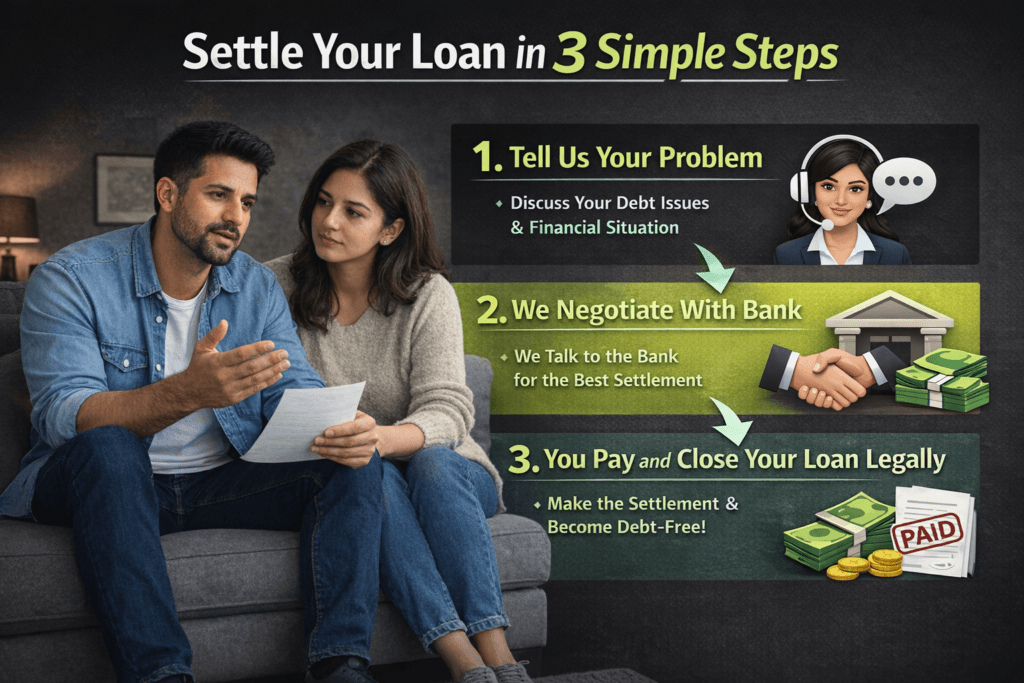

How TRUESETTLE works

Unlock Your FREEDOM With Just 6 Simple Steps!

Break free from the burden of loans with expert-led legal support. Protect yourself from harassment and settle your debts the right way.

We start by understanding your loan details and financial situation to plan the right approach for you.

If needed, we send formal legal notices to lenders, ensuring your rights are protected from the beginning.

Our team prepares a clear, realistic settlement proposal based on your case and the lender’s guidelines.

Our specialists directly negotiate with banks and recovery teams, using a legal framework to get the best possible terms.

Once terms are agreed, you receive a legal agreement, and we handle all documentation for a smooth process.

Your settlement is closed legally, an NOC is issued, and we provide guidance to gradually repair and improve your credit score.

Common Questions

Most Popular Questions

With several years of experience, we have gathered your most asked questions regarding loan settlement.

We help settle:

Credit Card Dues

Personal Loans

- Buy Now Pay Later (BNPL) Loans

Business Loans (unsecured)

Overdue EMI/Loan Defaults

- Education loan

- Vehicle loan

- More*

Yes, absolutely. Loan settlement is a legally allowed option where the lender agrees to accept a lower payment to close the loan. We only use ethical, legal, and RBI-compliant methods.

Yes. We work with clients from every corner of India via phone, video calls, and email. You can visit our office without any cost.

TrueSettle helps individuals and businesses legally settle their unsecured loans (like personal loans or credit card dues) by negotiating with banks and NBFCs for a one-time reduced settlement amount.

Free Consultation

Loan & Credit Review

You Pay the Agreed Fee

Negotiation with Lenders

Settlement Letter from Bank

- Pay OTS (one time settlement) or EMI to the Lender

Case Closed

- Get NOC

We don’t charge anything upfront, not even for the office visit. We only take a 10% professional fee of the total due amount — only if you are eligible for settlement. You'll get a free credit booster service as well. You also get a clear agreement before we begin.