A loan or credit card default can feel like a permanent stain on your financial life—but it isn’t. Credit damage is reversible if you follow the right strategy with discipline and patience. Thousands of borrowers rebuild their credit every year after defaults by understanding how the system works and taking calculated steps.

This guide explains how to rebuild your credit after defaults, what actually improves your credit score, and what mistakes to avoid so you don’t fall into the same cycle again.

Understanding What a Default Really Does to Your Credit

When you miss payments for a prolonged period, lenders report the account as overdue or defaulted to credit bureaus like Experian, Equifax, and TransUnion. This directly impacts your credit score, primarily because payment history carries the highest weight in credit scoring.

However, a low credit score does not mean you’re financially finished. It simply means lenders see higher risk—risk that can be reduced with time and responsible behavior.

Step 1: Pull Your Credit Report and Face the Reality

Before doing anything else, get your latest credit report. Many people delay this step out of fear—but clarity is power.

Check for:

- Incorrect late payment entries

- Loans that don’t belong to you

- Settled accounts still marked as “active”

- Wrong outstanding balances

Even a single error can drag your score down significantly.

Step 2: Dispute Errors That Don’t Belong to You

Credit report errors are more common than people realize. If you find inaccurate data, raise a dispute immediately with the credit bureau.

Correcting errors can:

- Instantly improve your credit score

- Remove unfair negative history

- Strengthen your profile before rebuilding starts

Always keep written records and follow up until resolution.

Step 3: Stop Further Damage Before Rebuilding

You cannot rebuild credit while actively damaging it.

This means:

- No new missed payments

- No unnecessary borrowing

- No ignoring lender communication

If you are still struggling with dues, address the problem first—through structured repayment, negotiation, or legal settlement—before focusing on score improvement.

Step 4: Create a Budget That Actually Works

A realistic budget is not about extreme cutbacks; it’s about sustainability.

Your budget should:

- Cover essentials first (rent, food, utilities)

- Allocate fixed money for debt obligations

- Leave room for emergencies

People fail at credit rebuilding because they design unrealistic plans. Consistency matters more than speed.

Step 5: Clear High-Impact Debts Strategically

If you have multiple overdue accounts, prioritize:

- High-interest credit cards

- Loans closest to legal escalation

- Accounts reported as “default” rather than “late”

In many cases, loan settlement may be a smarter option than endless EMIs—especially for unsecured loans. Settling legally reduces the burden and allows you to start rebuilding with a cleaner slate.

Step 6: Build a Strong Payment History Going Forward

Your future behavior matters more than your past mistakes.

Do this consistently:

- Pay every bill on time

- Use reminders or auto-debit

- Never miss minimum dues

A streak of on-time payments is the fastest long-term way to rebuild lender trust.

Step 7: Use Secured Credit Cards the Right Way

Secured credit cards are one of the safest tools for credit recovery.

How to use them effectively:

- Make small purchases only

- Keep utilization below 30%

- Pay the full balance every month

This shows responsible credit usage without risk of overborrowing.

Step 8: Become an Authorized User (If Possible)

If a trusted family member has:

- A long credit history

- Low utilization

- Perfect payment behavior

Becoming an authorized user on their card can positively reflect on your credit report. This strategy works only if the primary user is disciplined.

Step 9: Monitor Your Credit Like a Financial Asset

Credit rebuilding is not “set and forget.”

Regular monitoring helps you:

- Track improvements

- Spot new errors early

- Prevent identity misuse

Free and paid monitoring tools both work—what matters is consistency.

Step 10: Avoid Credit Traps and Quick-Fix Schemes

Stay away from:

- “Instant credit repair” promises

- Excessive loan applications

- Too many hard inquiries

Each unnecessary credit check can temporarily reduce your score. Apply only when required.

Step 11: Maintain a Healthy Credit Mix (Carefully)

A balanced mix of:

- Revolving credit (cards)

- Installment loans (personal, auto, home)

can help your score—but only if you can afford repayments. Never take credit just for score improvement.

Step 12: Communicate Early If Trouble Returns

If you foresee payment issues:

- Talk to lenders early

- Ask for modified terms

- Explore hardship programs

Silence damages credit more than honest communication.

Step 13: Consider Professional Guidance When Needed

Sometimes, self-management isn’t enough—especially after multiple defaults.

Professional debt advisors can:

- Help settle unsecured loans legally

- Stop recovery harassment

- Create structured recovery plans

- Guide you toward long-term credit rebuilding

The right help prevents repeated mistakes.

Final Thoughts: Credit Recovery Is a Marathon, Not a Shortcut

Defaults don’t define your financial future—your next decisions do.

By correcting errors, managing debt strategically, rebuilding payment history, and using credit responsibly, you can restore your creditworthiness step by step.

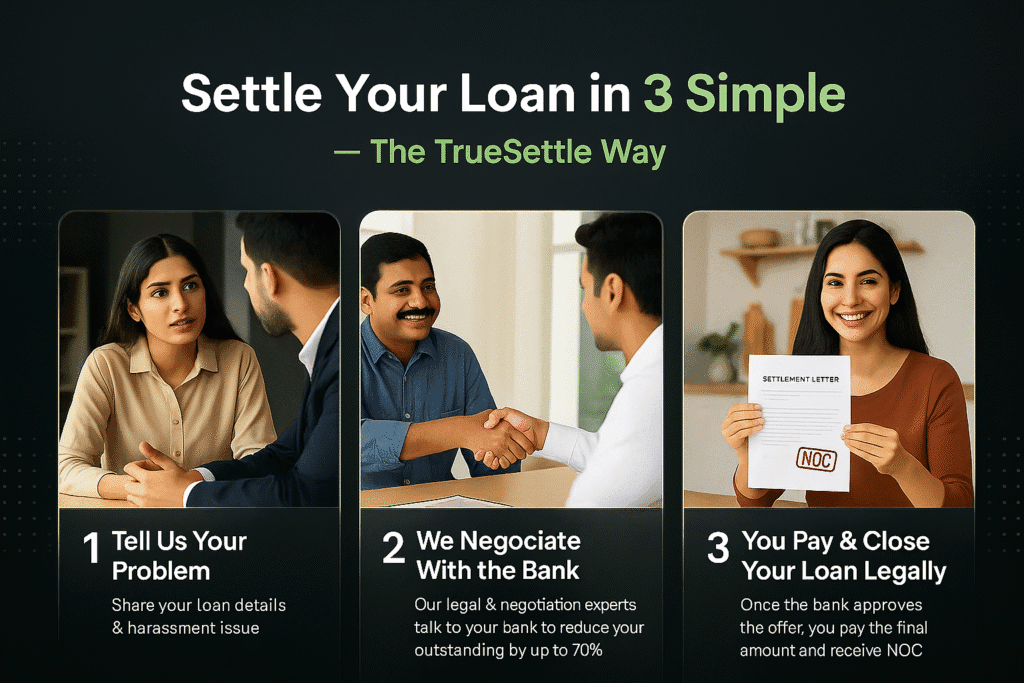

If you’re overwhelmed by unsecured loans or past defaults, TrueSettle helps borrowers reduce debt legally and rebuild their financial life with clarity and transparency.

👉 Visit www.truesettle.in and take the first step toward financial freedom.