The weight of unpaid loans doesn’t just drain your bank account—it takes a silent toll on your mind, relationships, and overall quality of life. In India, where millions grapple with mounting debt from personal loans, credit cards, and business liabilities, the psychological impact of debt extends far beyond financial statements.

At TrueSettle, we’ve witnessed firsthand how debt stress transforms confident professionals into anxious individuals, strains loving families, and robs people of peaceful sleep. But here’s the encouraging truth: understanding these psychological effects is the first step toward breaking free—and loan settlement in India offers a legally viable pathway to both financial and emotional relief.

The Hidden Mental Health Crisis: Debt Stress in India

Why Debt Feels Different in Indian Society

Unlike Western cultures where borrowing is normalized, Indian society attaches deep stigma to debt. The cultural emphasis on financial independence and family honor means that struggling with loans often triggers intense feelings of shame and inadequacy.

This financial stress and mental health connection manifests in several ways:

- Chronic Anxiety: The constant worry about recovery calls, mounting interest, and legal notices creates a persistent state of fear

- Depression and Hopelessness: Feeling trapped in a debt cycle with no visible exit leads to clinical depression in many cases

- Sleep Disorders: Debt anxiety commonly causes insomnia, with individuals lying awake calculating repayments and fearing the next day

- Physical Health Issues: Stress-induced conditions like hypertension, digestive problems, and weakened immunity

A survey of debt-stressed individuals revealed that 73% experienced anxiety symptoms, while 54% reported signs of depression—numbers that underscore the urgent need for comprehensive debt relief services India.

How Debt Destroys What Matters Most: Family and Relationships

The Ripple Effect on Your Loved Ones

Family stress due to debt extends beyond the borrower. When loan repayment pressure dominates household finances, the entire family ecosystem suffers:

Between Spouses:

- Constant arguments about money management

- Loss of trust when debt is hidden

- Reduced intimacy due to persistent financial worry

- Feelings of betrayal if debt was incurred without joint decision-making

Impact on Children:

- Sensing parental tension and developing anxiety themselves

- Missing out on educational or recreational opportunities

- Learning unhealthy financial behaviors

- Losing confidence in family stability

Social Withdrawal: The inability to participate in social gatherings, family functions, or even simple outings leads to isolation. When friends ask why you’re absent, the shame of debt often prevents honest conversation, further deepening loneliness.

The Emotional Rollercoaster of Loan Default and Recovery

Understanding Loan Default Stress

When payments are missed and loan default stress sets in, the psychological pressure intensifies dramatically:

Recovery Call Harassment: Multiple daily calls from recovery agents create a state of constant dread. The stress caused by loan recovery calls forces many to silence their phones entirely, disrupting work and personal life.

Public Humiliation: Threats of visiting workplaces or contacting relatives trigger fear of social exposure—one of the deepest psychological wounds for debt-stressed individuals.

Legal Anxiety: Notices and legal terminology cause panic, especially when borrowers don’t understand their rights or the actual implications.

Loss of Identity: Many describe feeling like they’ve become “just a defaulter” rather than the capable professional or loving parent they once were.

The Path to Relief: Psychological Effects of Loan Settlement

How the Loan Settlement Process Brings Mental Peace

While confronting debt through loan settlement in India requires initial courage, the psychological benefits are transformative:

Immediate Relief Indicators:

- Reduced Harassment: Professional negotiation stops aggressive recovery tactics

- Clear Pathway: Knowing there’s a concrete plan replaces hopeless uncertainty

- Regained Control: Active participation in settlement restores sense of agency

- Reduced Financial Burden: Negotiated settlements (typically 40-60% of outstanding amount) make freedom achievable

Long-term Emotional Recovery: The mental relief after loan settlement includes:

- Improved sleep quality within weeks

- Restored family harmony as financial pressure eases

- Gradual rebuilding of self-esteem

- Renewed ability to plan for the future

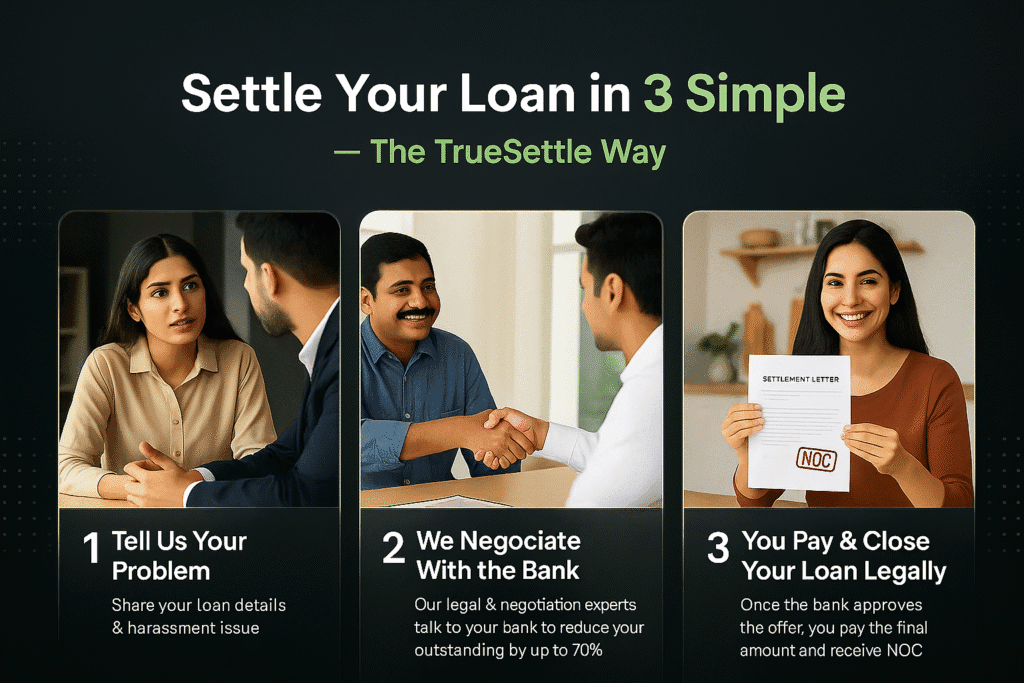

What Actually Happens During Loan Settlement?

The loan settlement process at TrueSettle involves:

- Comprehensive Debt Assessment: Understanding your complete financial picture

- Legal Protection: Safeguarding you from harassment under RBI guidelines and IPC Section 506

- Professional Negotiation: Experienced negotiators work with creditors to reduce your burden

- Structured Resolution: Clear timelines and achievable payment plans

- Credit Rehabilitation Guidance: Understanding how to rebuild after settlement

Learn more about Unsecured Loan Settlement Process →

Protecting Your Mental Health While Managing Debt

Immediate Coping Strategies for Debt Anxiety

While pursuing professional debt relief services India, these practices help manage daily stress:

Mental Health Practices:

- Mindfulness and Meditation: Even 10 minutes daily reduces anxiety significantly

- Physical Activity: Regular exercise combats stress hormones naturally

- Structured Sleep Routine: Maintaining consistent sleep hours despite worry

- Limited Screen Time: Reducing exposure to recovery messages and financial triggers

Practical Financial Steps:

- Document Everything: Keep records of all communications and notices

- Know Your Rights: Understanding borrower protections under RBI norms

- Stop Ignoring It: Avoidance increases anxiety; facing debt is liberating

- Seek Professional Help: Both financial counseling and mental health support

Know Your Rights Against Recovery Agent Harassment →

Building Your Support System

Professional Support:

- Financial Advisors: Specialized in unsecured loan settlement and debt restructuring

- Mental Health Counselors: Trained to address credit stress and financial anxiety

- Legal Experts: Protecting your rights throughout the process

Personal Support:

- Confiding in trusted family or friends reduces isolation

- Joining online support communities with others facing similar challenges

- Engaging with financial literacy programs to prevent future debt

Financial Literacy: The Prevention Strategy

Breaking the Cycle for Future Generations

Understanding personal finance fundamentals prevents the emotional impact of credit card debt and loan stress:

Essential Financial Skills:

- Emergency fund creation before borrowing

- Understanding interest calculations and compound effects

- Recognizing predatory lending practices

- Budgeting for needs vs. wants

- Smart credit card usage and timely payments

When to Seek Help Early: If you notice these warning signs, consider professional help for debt stress Indiaimmediately:

- Missing payments to cover other debts

- Using credit cards for basic necessities

- Avoiding calls from creditors

- Experiencing physical symptoms of stress

- Hiding financial situation from family

Credit Score Impact After Loan Settlement – What to Expect →

The TrueSettle Difference: Compassionate Debt Resolution

Why Choose Professional Loan Settlement?

At TrueSettle, we understand that numbers on a statement don’t capture the sleepless nights, strained relationships, or lost confidence that debt creates. Our approach combines:

✓ Legal Expertise: Navigating RBI guidelines and borrower protection laws ✓ Proven Negotiation: Years of experience achieving favorable settlements ✓ Psychological Sensitivity: Treating clients with dignity during vulnerable times ✓ Holistic Support: Addressing both financial and emotional aspects of debt ✓ Transparent Process: No hidden fees, clear communication throughout

Real Impact: Our clients report significant improvements in mental well-being within the first month of beginning the settlement process. The combination of stopping harassment, seeing a clear path forward, and having professional advocates transforms their daily experience.

Frequently Asked Questions About Debt Stress and Loan Settlement

General Debt Stress Questions

Q1: How does debt affect mental health in India specifically? A: Debt affects mental health through multiple pathways in India. The cultural stigma around borrowing creates shame and social anxiety that Western countries may not experience as intensely. Studies show 73% of debt-stressed Indians experience chronic anxiety, 54% show depression symptoms, and many develop physical health issues like hypertension. The fear of social exposure and family dishonor amplifies these effects significantly.

Q2: What are the early warning signs of debt-related mental health issues? A: Watch for these indicators:

- Persistent insomnia or sleep disturbances related to financial worries

- Avoiding phone calls and social interactions

- Increased irritability or mood swings

- Physical symptoms like headaches, stomach issues, or chest tightness

- Difficulty concentrating at work

- Withdrawing from family activities

- Feelings of hopelessness about the future If you notice multiple signs, seek professional help for debt stress India immediately.

Q3: Can debt stress affect my physical health too? A: Absolutely. Chronic financial stress triggers cortisol release, leading to high blood pressure, weakened immunity, digestive disorders, and increased risk of heart disease. Many debt-stressed individuals also develop unhealthy coping mechanisms like overeating, substance use, or neglecting exercise, compounding physical health problems.

Q4: How do I cope with stress caused by loan recovery calls? A: Immediate steps include:

- Document every call (time, agent name, threats made)

- Know your rights under RBI guidelines – agents cannot call before 7 AM or after 7 PM

- File complaints with banking ombudsman for harassment

- Engage TrueSettle’s anti-harassment services for legal protection

- Block numbers if legally permissible

- Never share additional personal information during threatening calls

Q5: Is it normal to feel suicidal thoughts due to debt? A: While unfortunately common, suicidal thoughts are a serious mental health emergency. Debt is a solvable financial problem – it is never worth your life. If experiencing such thoughts:

- Call suicide prevention helpline: 9152987821 (AASRA) immediately

- Speak to a mental health professional

- Tell a trusted friend or family member

- Remember: loan settlement can reduce debt by 40-60%, making it manageable Professional help at TrueSettle combined with mental health support can resolve this crisis.

Loan Settlement Process Questions

Q6: What types of loans can be settled in India? A: Most unsecured loans are settleable:

- Personal loans

- Credit card debt

- Business loans (unsecured)

- Peer-to-peer lending

- Microfinance loans

- Medical/education loans (unsecured)

Secured loans (home loans, vehicle loans) typically cannot be settled as they have collateral.

Q7: How much can I reduce my debt through loan settlement? A: Typical settlement outcomes range from 40-60% reduction of the outstanding principal amount. For example, a ₹5 lakh debt might settle for ₹2-3 lakhs. The exact amount depends on:

- Your financial hardship documentation

- Length of default period

- Creditor’s internal policies

- Your negotiator’s expertise TrueSettle’s experienced team maximizes your reduction while ensuring legal compliance.

Q8: Will loan settlement damage my credit score permanently? A: Settlement impacts credit scores initially, typically dropping them by 75-100 points. However:

- Scores recover within 18-24 months with responsible behavior

- A “settled” status is better than “written-off” or continuous default

- Mental health benefits and harassment cessation often outweigh temporary credit impact

- You can rebuild credit through secured credit cards and small on-time payments Credit Score Impact After Loan Settlement – Complete Guide →

Q9: How long does the loan settlement process take? A: Timeline varies by complexity:

- Simple cases: 2-4 months

- Multiple creditors: 4-8 months

- Complex situations: 6-12 months

Immediate benefits (stopping harassment, mental relief) begin within weeks of engaging professional services.

Q10: Is loan settlement legal in India? Will I face legal consequences? A: Yes, loan settlement is completely legal. It’s a civil negotiation between debtor and creditor, not a criminal matter. Key legal protections:

- RBI guidelines support settlement negotiations

- No jail for civil debt (unless fraud is proven)

- Borrowers have legal rights against harassment (IPC Section 506)

- Settlement is a recognized debt resolution method

TrueSettle ensures all settlements comply with Indian banking regulations and legal frameworks.

Q11: What happens if the bank rejects my settlement offer? A: Rejection is part of negotiation. Professional services like TrueSettle:

- Revise offers with additional documentation

- Engage senior bank officials

- Explore alternative resolution paths

- May recommend waiting before resubmitting

- Never give up on first rejection

Banks prefer settlement to complete write-offs, so persistence typically succeeds.

Q12: Can I settle loans while still employed? A: Yes. Employment doesn’t disqualify you from settlement. What matters is demonstrating:

- Current inability to pay full amount

- Financial hardship (medical bills, income reduction, family emergency)

- Good faith effort to resolve debt

Many employed individuals successfully settle when facing genuine financial crisis.

Family and Relationship Questions

Q13: How do I tell my spouse about hidden debt? A: Disclosure requires careful approach:

- Choose a calm, private moment

- Take full responsibility without making excuses

- Present the complete picture with documentation

- Immediately share your resolution plan (like engaging TrueSettle)

- Reassure commitment to fixing the situation

- Listen to their feelings without defensiveness

Professional financial counseling together can help rebuild trust while addressing debt.

Q14: Will loan settlement affect my children’s future? A: Settlement itself doesn’t directly impact children. However:

- Positive impacts: Reduced family stress, better mental health, financial stability

- Minimal impacts: Your credit challenges don’t transfer to children

- Educational note: Use this as a teaching moment about financial responsibility

Resolving debt through settlement protects children from ongoing financial tension better than prolonged default.

Q15: How do I handle family/friends knowing about my debt situation? A: Social stigma is real but manageable:

- Remember: Financial struggles affect millions; you’re not alone

- Share only with those who need to know or can genuinely support

- Frame it as “taking responsible steps to resolve” rather than “failed financially”

- Set boundaries with judgmental relatives

- Focus on recovery, not past mistakes

Many successful people have overcome debt – it doesn’t define your worth.

TrueSettle-Specific Questions

Q16: What makes TrueSettle different from other debt settlement services? A: TrueSettle offers comprehensive support:

- ✓ Legal protection from harassment (RBI compliance)

- ✓ Experienced negotiators with proven bank relationships

- ✓ Transparent pricing with no hidden fees

- ✓ Psychological sensitivity training for staff

- ✓ Post-settlement credit rehabilitation guidance

- ✓ Confidential, judgment-free environment

- ✓ Both financial and emotional support resources

Q17: How much does TrueSettle’s loan settlement service cost? A: Pricing is transparent and affordable, typically 10-15% of the settled amount (not the original debt). For example, if we settle your ₹5 lakh debt for ₹2.5 lakhs, fees would be on the ₹2.5 lakh settled amount. We work on success-based models – you pay only when settlement succeeds. Contact us for personalized assessment.

Q18: Is my information confidential with TrueSettle? A: Absolutely. We maintain strict confidentiality:

- No disclosure to employers or unauthorized third parties

- Secure document handling with encrypted storage

- Privacy compliance with Indian data protection laws

- Discreet communication methods per your preference

Your privacy and dignity are paramount throughout the process.

Q19: Can TrueSettle stop recovery agents from harassing me immediately? A: Yes. Once you engage our services:

- We send legal notice to creditors citing your representation

- Recovery calls reduce significantly within 7-10 days

- We handle all creditor communication on your behalf

- Any continued harassment is documented for legal action

- You receive legal protection under RBI anti-harassment guidelines

Q20: What if I can’t afford the lump sum settlement amount? A: TrueSettle negotiates for:

- Extended payment timelines (3-12 months installments)

- Partial settlements with multiple payments

- Restructured payment plans matching your cash flow

- Priority creditor settlements

We work within your realistic financial capacity, not theoretical ideals.

Anti-Harassment Services – Your Rights and Protection →

Take the First Step Toward Financial and Emotional Freedom

The psychological weight of debt doesn’t have to define your life. Thousands of Indians have reclaimed their mental peace, restored their relationships, and rebuilt their financial futures through professional loan settlement.

You deserve:

- Peaceful sleep without debt-related nightmares

- Harmonious family relationships free from financial tension

- The confidence to answer your phone without fear

- A clear pathway to a debt-free future

Ready to Break Free from Debt Stress?

Struggling with debt stress or recovery pressure? TrueSettle helps you legally reduce your loan burden while protecting your mental peace. Our compassionate experts handle the negotiations while you focus on healing and recovery.

📞 Get Confidential Debt Assessment Today

👉 Visit www.truesettle.in and take the first step towards financial and emotional freedom.

Tags: Category: Financial Well-Being | Debt Awareness | Loan Settlement Guidance