Struggling to repay your personal loan? You’re not alone. Thousands of borrowers across India face financial hardship due to job loss, medical emergencies, or business setbacks that make loan repayment impossible. When regular EMIs become unaffordable, personal loan settlement offers a legal and practical solution to reduce your debt burden and achieve financial freedom.

This comprehensive guide reveals proven strategies to negotiate personal loan settlement effectively, protect your legal rights under RBI guidelines, and minimise the impact on your credit score. Whether you’re dealing with HDFC, SBI, ICICI, or any other lender, these expert tactics will help you settle your loan for 40-60% less than what you owe.

What is Personal Loan Settlement?

Personal loan settlement is a debt resolution process where you negotiate with your lender to pay a reduced lump sum amount to close your loan account permanently. Instead of paying the full outstanding amount (including principal, interest, and penalties), you settle for significantly less—typically 30-60% of the total dues.

This legal process is designed for borrowers facing genuine financial hardship who cannot continue regular EMI payments. Settlement prevents legal action, stops harassment from recovery agents, and provides a fresh financial start, though it does impact your CIBIL score temporarily.

Key components of personal loan settlement:

Reduced payment: You pay substantially less than the total outstanding amount. For example, a ₹5 lakh outstanding loan might settle for ₹2-3 lakhs.

Lump sum arrangement: Settlement requires a one-time payment or structured payment over 2-3 months, not continued EMIs.

Loan closure: Once you pay the agreed settlement amount, the lender closes your loan account and issues a No Objection Certificate (NOC).

Credit impact: Your credit report will show the account as “settled” rather than “closed,” which affects your credit score but is better than default or legal action.

Personal loan settlement works best when you have access to a lump sum amount—through savings, asset liquidation, or family support—but cannot afford to continue monthly payments due to sustained financial difficulties.

Why Negotiation is Critical in Loan Settlement

Many borrowers make the costly mistake of accepting their lender’s first settlement offer without negotiation. Banks and NBFCs often present initial offers that are higher than necessary because they expect negotiation. Without proper strategy, you might end up paying 70-80% when you could have settled for 40-50%.

Strategic negotiation delivers multiple benefits:

Significant cost reduction: Effective negotiation can reduce your settlement amount by ₹1-2 lakhs or more. Every percentage point you negotiate saves thousands of rupees.

Better credit reporting: Some lenders agree to report the account as “closed” instead of “settled” if you negotiate a higher percentage payment, reducing long-term credit damage.

Faster resolution: Banks prefer quick settlements over prolonged defaults. Demonstrating serious intent and readiness with a structured offer speeds up approval.

Legal protection: Negotiating comprehensive written terms protects you from future claims, surprise charges, or incomplete loan closure.

Reduced harassment: Proactive negotiation shows good faith, often leading to immediate cessation of aggressive recovery calls and visits.

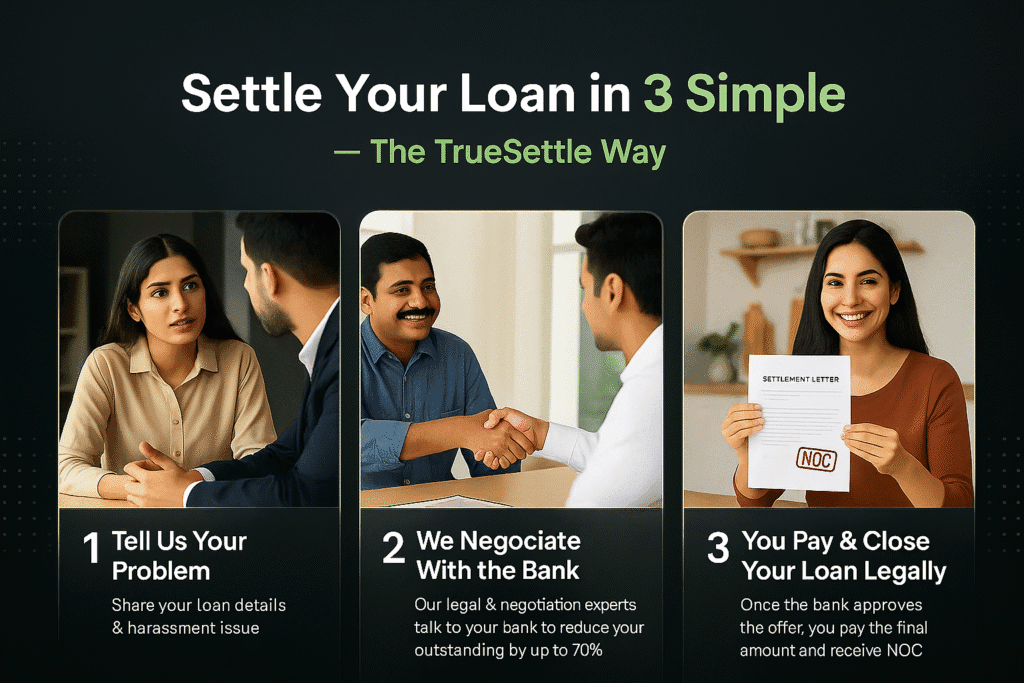

Professional negotiators or settlement experts like TrueSettle typically achieve 10-20% better terms than DIY attempts because we understand lender policies, have established banking relationships, and know exactly which charges can be waived and which cannot.

How to Negotiate Personal Loan Settlement: Complete Process

Successfully settling your personal loan requires following a structured approach. Here’s the proven step-by-step process that has helped thousands of borrowers achieve favorable settlements.

Step 1: Assess Your Complete Financial Situation

Before contacting your lender, you need absolute clarity on your financial position. This foundation determines your negotiation strength and maximum affordable offer.

Calculate your settlement capacity: Review your savings, fixed deposits, mutual funds, and other liquid assets. Determine the maximum lump sum you can arrange without creating new debt. If borrowing from family, ensure commitments are realistic.

Document your hardship: Gather concrete proof of financial distress. This includes medical bills for serious illness, termination or resignation letters, business closure certificates, income tax returns showing reduced income, or bank statements proving financial decline. Strong documentation justifies your settlement request.

Analyze your loan account: Request a complete statement showing principal outstanding, interest accrued, penalty charges, legal notice fees, and any other charges. Understanding each component helps you identify which charges to challenge during negotiation.

Timeline: Spend 2-3 days on this step. Rushing weakens your position.

Step 2: Make First Contact with Your Lender

Timing and approach matter significantly. Contact your lender as soon as you recognize inability to continue payments, but after completing your financial assessment.

Call the right department: Don’t speak with regular customer service. Request connection to the loan settlement department, recovery department, or write-off cell. These specialized teams have authority to negotiate.

Professional communication: Remain calm, respectful, and factual. Explain your situation clearly: “I lost my job in September and have been unemployed for four months. I cannot continue EMIs but want to resolve this debt honorably.”

Express serious intent: Make clear you’re not avoiding payment but seeking a realistic solution. State that you have a specific amount available for settlement.

Request detailed statement: Ask for a complete breakdown of outstanding dues. This provides negotiation leverage when you identify excessive penalties or compounded interest.

Timeline: Initial contact typically takes 1-2 days as you may need to call multiple times to reach the right person.

Step 3: Make Your Opening Settlement Offer

Your initial offer sets the negotiation foundation. It should be strategic—low enough to provide negotiation room but high enough to be taken seriously.

Calculate your offer: For loans 6+ months in default, start with 30-35% of total outstanding. For 3-6 months default, begin with 45-50%. Back this with your financial hardship evidence.

Present in writing: Send a formal email to the settlement department stating: your loan account number, outstanding amount as per your records, your proposed settlement amount, brief hardship explanation, and request for written response.

Follow up with call: After sending the email, call to confirm receipt and request timeline for response. This shows you’re serious.

Expect rejection: Your first offer will likely be rejected. This is normal and expected. The goal is starting the conversation, not immediate acceptance.

Timeline: Submit your offer within 1-2 days of initial contact. Lenders typically respond within 5-7 working days.

Step 4: Negotiate Penalty Waivers and Interest Reduction

The principal loan amount is typically non-negotiable, but penalties, interest, and fees offer substantial room for reduction. This is where most settlement savings occur.

Target these charges:

Late payment penalties: Often 2-4% of overdue amount monthly. Request complete waiver citing financial hardship.

Penal interest: Extra interest charged on default, usually 2-3% above normal rate. Negotiate for reduction or removal.

Legal notice fees: Banks add ₹5,000-15,000 for legal notices. Challenge these as the loan isn’t actually in litigation.

Processing charges for settlement: Some lenders add settlement processing fees. Refuse these as unreasonable.

Compounded interest: If interest has been compounding on unpaid interest, request calculation on simple interest basis only.

Negotiation strategy: “I understand the principal must be paid, but the penalties and compounded interest have made this unmanageable. I can pay ₹X, which covers the principal and reasonable interest, if you waive the penalty charges.”

Timeline: Multiple rounds of negotiation typically take 2-4 weeks. Patience and persistence are essential.

Step 5: Get Everything in Writing Before Paying

This is the most critical step that many borrowers skip, leading to future problems. Never make any settlement payment without comprehensive written documentation.

Your settlement agreement must clearly state:

Exact settlement amount: Specific figure in numbers and words, leaving no ambiguity.

Payment deadline: Clear date by which payment must be made to honor the agreement.

Full and final closure: Explicit statement that this payment will completely close the loan with no further dues.

NOC commitment: Lender agrees to provide No Objection Certificate within specified timeframe (typically 15-30 days).

Credit bureau reporting: Specify exactly how the account will be reported. Request “closed” if possible, accept “settled” if negotiated.

Bank signatory: Ensure the agreement is signed by an authorized bank official with name, designation, and date.

Zero liability clause: Statement confirming no further amounts are due and the borrower has no liability after settlement payment.

Obtain this in writing: Via email from official bank email address or on bank letterhead with proper authorization. Verbal agreements or WhatsApp messages from recovery agents have zero legal value.

Timeline: Insist on receiving written agreement within 3-5 days of verbal agreement. Do not make payment until you have it.

Step 6: Make Settlement Payment with Proper Documentation

Once you have written agreement, make payment through traceable methods to maintain proof.

Approved payment methods:

NEFT/RTGS/IMPS: Electronic transfer with complete transaction records.

Demand Draft: Physical instrument with bank guarantee and tracking.

Account payee cheque: If insisting on cheque, ensure it’s account payee only.

Never use: Cash payments (no proof), third-party transfers, or payments to recovery agent personal accounts.

Maintain documentation: Save transaction confirmation, bank statements showing debit, email confirmations, and any payment receipts. Take screenshots and keep physical copies.

Confirm receipt: After payment, get written acknowledgment from the bank confirming receipt of settlement amount.

Timeline: Make payment within the agreed deadline. Early payment is fine; late payment may void the agreement.

Step 7: Obtain NOC and Verify Loan Closure

Your settlement isn’t complete until you receive official loan closure documentation and verify credit report updates.

Follow up for NOC: The lender should provide a No Objection Certificate within 15-30 days of payment. If delayed, send written reminders every week citing your settlement agreement.

NOC must contain:

- Loan account number

- Confirmation of full settlement payment received

- Statement that no further dues exist

- Loan account officially closed

- Bank stamp and authorized signature

Loan closure letter: Some banks issue separate loan closure certificates. Obtain this as well.

Credit report verification: After 30-45 days, check your CIBIL, Experian, and Equifax reports. Verify the loan shows as “settled” or “closed” as per agreement. If reported incorrectly, file disputes immediately with proof of your settlement.

Timeline: Complete closure documentation should be in hand within 4-6 weeks of settlement payment.

Total estimated time: From initial contact to complete closure: 6-12 weeks for most cases.

Top Strategies to Maximize Your Loan Settlement Success

Beyond the basic process, these advanced tactics significantly improve your settlement terms.

Understand and Leverage the Lender’s Motivation

Banks and NBFCs face strict RBI regulations about Non-Performing Assets (NPAs). Once your loan crosses 90 days of default, it becomes an NPA, requiring the bank to set aside additional capital (provisioning) and report it on their balance sheet—both undesirable outcomes.

Use this knowledge strategically:

Emphasize immediate recovery: “I have ₹X available now for immediate settlement. Continuing default means you may recover nothing and face higher provisioning costs.”

Highlight alternative outcomes: “Without settlement, I have no option except declaring insolvency, meaning potential total write-off.”

Reference their NPA concerns: “I understand this account affects your NPA ratios. Quick settlement helps both of us.”

Banks prefer recovering 40-50% immediately over a slim chance of recovering 100% through years of legal proceedings. Position your offer as their best realistic option.

Negotiate During Financial Year-End

Banks have quarterly and annual targets for NPA resolution and recovery. Approaching settlement negotiations during Q4 (January-March) or at quarter-ends gives you leverage because relationship managers want to close pending settlements to meet targets.

Best timing windows:

- March (financial year-end)

- December (calendar year-end for some NBFCs)

- September and December (quarter-ends)

Relationship managers have more authority and flexibility during these periods. They may accept lower percentages they’d reject in other months.

Bundle Multiple Loans for Better Deals

If you have multiple loans or credit cards with the same lender, negotiate them together. Banks prefer comprehensive settlement over piecemeal deals.

Approach: “I have three accounts with you totaling ₹8 lakhs outstanding. I can arrange ₹3.2 lakhs to settle all three together if you agree to 40% settlement across the board.”

Bundling increases your negotiating power and often results in better overall percentages than individual settlements.

Use Professional Representation Strategically

While you can negotiate directly, professional settlement services like TrueSettle offer distinct advantages:

Established banking relationships: We maintain ongoing relationships with settlement departments across banks, enabling faster responses and better terms.

Expert knowledge: We understand which banks accept what percentages, which charges are negotiable, and which arguments work with specific lenders.

Emotional distance: Negotiations can be stressful. Professional negotiators remain objective and don’t make emotional decisions under pressure.

Legal protection: We ensure all documentation is legally sound, protecting you from future claims.

Better outcomes: Our clients typically achieve 10-20% better settlement terms than DIY attempts, often covering our fees multiple times over in savings.

Harassment buffer: We handle all communication with recovery agents, immediately stopping harassment while facilitating constructive settlement discussions.

Consider professional help especially if you’re dealing with aggressive recovery tactics, large loan amounts (₹5 lakhs+), or multiple lenders simultaneously.

Stand Firm on Reasonable Offers

Once you’ve made a fair offer backed by genuine hardship documentation, maintain your position. Recovery agents may try pressure tactics:

Common pressure tactics:

- “This is our final offer, take it or leave it”

- “Your offer is too low, we can’t even present it”

- “If you don’t accept now, we’ll proceed with legal action”

- “We’ll seize your assets if you don’t pay more”

Your response: “I understand your position, but ₹X is my maximum capacity. I’m offering this in good faith for immediate settlement. If that doesn’t work for you, I’ll need to explore other options like approaching the RBI Ombudsman or debt counseling services.”

Maintain calm professionalism. More than half of “final offers” aren’t actually final. If your offer is reasonable (35-50% of outstanding), stick with it. The lender will likely return after consulting internally.

Legal Protections for Borrowers in India

Understanding your legal rights prevents exploitation during the settlement process and protects you from harassment.

RBI Guidelines on Fair Practices

The Reserve Bank of India mandates strict fair practice codes for all lenders. These guidelines protect borrowers from aggressive or unethical recovery tactics.

RBI regulations prohibit lenders from:

Harassment at odd hours: Recovery agents cannot call before 7 AM or after 7 PM.

Visiting without notice: Physical visits to your home or workplace require advance written notice.

Threatening language: Agents cannot threaten violence, use abusive language, or make false legal threats.

Contacting third parties: Lenders cannot disclose your loan details to neighbors, relatives (except guarantors), or employers.

Misrepresentation: Cannot falsely claim to be law enforcement or make threats they have no legal authority to execute.

If you face violations: Document all incidents, file written complaints with the lender’s grievance redressal cell, escalate to the Banking Ombudsman if unresolved, and report severe harassment to local police under IPC Section 506 (criminal intimidation).

The RBI takes these violations seriously. Banks risk regulatory action and penalties for non-compliance with fair practice codes.

Consumer Protection Act, 2019

This act provides additional protection against deficient services and unfair trade practices by lenders.

Your rights under Consumer Protection Act:

Right to be heard: Lenders must provide proper grievance redressal mechanisms.

Right to information: Complete transparency about charges, settlement terms, and account status.

Right to fair treatment: Protection against unreasonable or discriminatory settlement terms.

Right to compensation: You can file complaints with Consumer Forums for harassment, mental agony, or unfair practices.

How to use this protection: File complaints with District Consumer Forum (for disputes up to ₹50 lakhs), State Consumer Commission (₹50 lakhs to ₹2 crores), or National Consumer Commission (above ₹2 crores or appeals).

Consumer Forums have awarded compensation to borrowers for harassment and unfair practices, sometimes ordering lenders to pay damages in addition to accepting loan settlement.

Debt Recovery Tribunal (DRT)

For personal loans above ₹20 lakhs, lenders can approach the Debt Recovery Tribunal for recovery. However, this also provides you a structured legal forum for dispute resolution.

DRT process:

Filing: Lender files recovery application in the DRT with jurisdiction over the area.

Defense opportunity: You receive notice and can file a written statement presenting your defense, including settlement offers.

Conciliation: DRT often encourages settlement through conciliation before formal proceedings.

Transparency: Unlike aggressive recovery tactics, DRT provides a formal, transparent process with proper legal representation opportunity.

If a lender threatens DRT action, don’t panic. Use it as an opportunity to present formal settlement proposals. Many DRT cases end in negotiated settlements rather than judgments.

Right to Approach RBI Ombudsman

The Banking Ombudsman Scheme provides free, accessible redressal for complaints against banks and NBFCs.

You can approach the Ombudsman for:

- Excessive or wrongful recovery tactics

- Refusal to provide written settlement agreements

- Failure to issue NOC after settlement payment

- Incorrect credit bureau reporting

- Non-adherence to RBI guidelines

Process:

File complaint online at RBI website, provide documentary evidence of issues, wait for Ombudsman mediation between you and the lender, and receive binding resolution typically within 60-90 days.

The Ombudsman can order banks to correct errors, compensate for losses, and adhere to settlement terms. This free service provides powerful recourse when direct negotiation fails.

Common Mistakes to Avoid During Loan Settlement

Learning from others’ mistakes saves you time, money, and complications.

Accepting Verbal Agreements

The mistake: Recovery agents offer attractive settlement terms over phone calls or WhatsApp messages, and borrowers pay immediately based on these verbal assurances.

The consequence: After payment, the agent claims different terms, denies the conversation, or disappears. Without written proof, you have no legal recourse.

The solution: No matter how pressured you feel or how good the verbal offer sounds, insist on written agreement from official bank email or letterhead before any payment. If agents refuse, escalate to their manager or formal settlement department.

Settling Without Exploring Alternatives First

The mistake: Rushing into settlement without considering other options that might better suit your situation.

Better alternatives to evaluate:

Loan restructuring: Some banks offer temporary EMI reduction, tenure extension, or moratorium periods without credit score impact. Request this before defaulting.

Balance transfer: If you’re not yet in default, transferring to a lower interest rate loan might make EMIs manageable again.

Partial settlement: Some lenders accept paying 80-90% with remaining 10-20% waived, reported as “closed” rather than “settled,” minimizing credit damage.

Debt consolidation: Combining multiple debts into one lower-EMI loan if you’re still credit-worthy.

The solution: Exhaust other options before choosing settlement. Consult with TrueSettle’s advisors to evaluate all alternatives before deciding.

Making Unrealistically Low Offers

The mistake: Offering 15-20% settlement on recently defaulted loans (1-3 months) or offering 10-15% on any loan without strong hardship justification.

The consequence: Immediate rejection, loss of negotiating credibility, and the lender becoming less willing to negotiate seriously.

Why it backfires: Lenders know typical settlement ranges. Absurdly low offers signal either ignorance or bad faith, making them less cooperative.

The solution: Research realistic settlement percentages for your situation. Typically 30-40% for severe default (6+ months), 50-60% for recent default (3-6 months). Start at the lower end of the realistic range, not wishful thinking numbers.

Ignoring the Credit Score Impact

The mistake: Assuming settlement has no consequences or that credit score doesn’t matter anymore.

The reality: Settlement reduces your CIBIL score by 75-100 points typically. This affects loan approval for 18-24 months minimum, results in higher interest rates when you do qualify, and impacts even some job applications and rental agreements.

The solution: Before settling, understand the credit consequences fully, plan for credit rebuilding immediately after settlement, avoid applying for new credit for at least 12 months post-settlement, and consider whether paying 70-80% to get “closed” status is worth preserving your credit score.

Paying Without Receiving NOC

The mistake: Making settlement payment and then waiting passively for NOC without follow-up.

The consequence: Some lenders delay or “forget” to issue NOC. Months later, you discover the loan still shows as active, or worse, they claim the settlement was partial and demand more payment.

The solution: Track NOC issuance timeline strictly. If not received within the agreed timeframe (typically 15-30 days), send written reminders weekly via email and registered post. Escalate to branch manager, then grievance cell, then Ombudsman if needed. Never assume silence means closure.

Not Addressing Co-Borrowers or Guarantors

The mistake: Settling your liability without ensuring co-borrowers or guarantors are also released.

The consequence: The lender pursues co-borrowers or guarantors for the remaining amount, causing family conflicts and legal complications.

The solution: If your loan has co-borrowers or guarantors, ensure the settlement agreement explicitly states ALL parties are released from liability. Get separate NOCs issued to each person. Verify with co-borrowers that their credit reports also reflect settlement.

How to Rebuild Your Credit Score After Loan Settlement

Settlement damages your credit score temporarily, but disciplined financial behavior can restore it to acceptable levels within 18-24 months.

Immediate Actions (Month 1-3)

Obtain all three credit reports: Get your latest reports from CIBIL, Experian, and Equifax within 30 days of settlement. These cost ₹500-800 each but are essential.

Verify settlement reporting: Confirm the settled loan shows correct status (“settled” or “closed” as per your agreement), correct settlement date, and zero outstanding balance. Each bureau may report slightly differently.

Dispute inaccuracies immediately: If anything is incorrect—wrong settlement amount, continuing to show outstanding balance, missing settlement date—file disputes with the credit bureau using your settlement agreement and NOC as proof. Bureaus must investigate within 30 days.

Understand your new baseline: Your score will likely drop by 75-100 points. A 750 score might become 650-675. This is your starting point for rebuilding.

Create a recovery plan: Set a target score (typically 720+) and timeline (18-24 months) for recovery. Plan specific actions each quarter.

Short-term Strategy (Month 3-12)

Maintain perfect payment record on remaining accounts: If you have other loans, credit cards, or utility bills, ensure 100% on-time payments. Even one late payment during recovery destroys months of progress.

Keep credit utilization under 30%: If you have active credit cards, use only 30% of your credit limit. For a ₹1 lakh limit, keep outstanding below ₹30,000. Lower is better—under 10% is ideal.

Don’t close old credit accounts: Your credit age matters. Keep your oldest credit card active even if you don’t use it much. Closing it reduces your average credit age, lowering your score.

Pay bills before due dates: Payment history contributes 30-35% of your credit score. Set automatic payments or calendar reminders to never miss due dates.

Monitor score monthly: Most banks now offer free credit score tracking. Check monthly to see progress and catch any errors early.

Medium-term Strategy (Month 12-18)

Get a secured credit card: Apply for a credit card secured against a fixed deposit. Since it’s backed by your FD, banks approve even with lower credit scores.

Use and pay off secured card: Make small purchases monthly (₹2,000-5,000), pay the full balance before due date. This demonstrates responsible credit behavior.

Consider a credit builder loan: Some banks offer small loans specifically for credit rebuilding. Borrow ₹50,000-1,00,000, let it sit in a FD, and repay on time. The positive payment history rebuilds your credit.

Avoid new loan applications: Each application creates a “hard inquiry” on your credit report, lowering your score by 5-10 points. Multiple inquiries signal credit desperation. Wait until your score reaches 700+ before applying for significant new credit.

Diversify credit types: If you only had personal loans, adding a secured credit card creates “credit mix,” which contributes 10% of your score.

Long-term Strategy (Month 18-24)

Increase credit limits: Once your secured credit card has a year of perfect payment history, request a limit increase or convert to an unsecured card. Higher limits lower your utilization ratio if spending stays constant.

Add yourself as authorized user: If a family member with excellent credit is willing, being added as authorized user on their card can help, especially if they have a long credit history.

Take small unsecured credit: After 18 months of perfect payment history on secured products, try applying for a small unsecured personal loan (₹50,000-1,00,000) from a digital lender. Successful repayment demonstrates you’re creditworthy again.

Continue monitoring: Even after reaching your target score, maintain quarterly checks to catch errors and continue healthy credit habits.

Typical timeline:

- Months 0-6: Score remains low (600-650 range), focus on disputes and accuracy

- Months 6-12: Gradual improvement (650-680 range), secured credit products working

- Months 12-18: Steady climbing (680-720 range), credit behavior well established

- Months 18-24: Near-normal levels (720-750 range), ready for new credit if needed

With disciplined effort, most borrowers reach a “good” credit score (720+) within 18-24 months after settlement, qualifying for new loans albeit at slightly higher interest rates than prime borrowers.

Why Choose TrueSettle for Professional Loan Settlement

Navigating loan settlement independently is possible, but professional expertise often saves significantly more than it costs while protecting you from costly mistakes.

Our Expert Negotiation Advantage

TrueSettle’s specialized team brings years of experience in debt resolution and established relationships with settlement departments across all major banks and NBFCs.

Our negotiation edge:

Bank relationships: We maintain ongoing working relationships with settlement heads at HDFC, ICICI, SBI, Axis, Bajaj Finserv, and 20+ other lenders. This access gets your case reviewed faster and more seriously.

Insider knowledge: We know each lender’s settlement policies, typical acceptance ranges, and which arguments work with which banks. This intelligence shapes our strategy for your specific lender.

Data-driven approach: Having settled thousands of loans, we know what settlement percentages are achievable for your loan amount, default duration, and lender. We set realistic targets and push for the best possible terms within that range.

Professional pressure: Banks take calls from established settlement firms more seriously than individual borrowers. Our involvement signals you’re serious about settlement, not just delaying payment.

Better outcomes: Our clients typically achieve 10-20% better settlement terms than DIY negotiations, often saving ₹50,000-2,00,000 more than they would negotiating alone.

Complete Legal Protection and Documentation

Loan settlement involves legal agreements and has lasting financial implications. Our legal expertise ensures you’re fully protected.

How we protect you:

Comprehensive agreement review: We draft or review all settlement agreements to ensure every clause protects your interests—complete loan closure, no future liability, specific NOC timelines, and credit reporting terms.

RBI compliance verification: We ensure all settlement terms comply with RBI guidelines and fair practice codes, protecting you from unfair or illegal terms.

Document management: We maintain complete documentation of all communications, offers, agreements, and payments, providing you a complete legal record.

NOC follow-up: We don’t consider the case closed until you have your NOC in hand and credit reports are correctly updated. We handle all follow-up for documentation.

Dispute resolution: If issues arise—lender claims different terms, delays NOC, reports incorrectly to credit bureaus—we represent you in disputes, file complaints with the Ombudsman if needed, and pursue resolution.

Immediate Harassment Prevention

One of the most valuable yet overlooked benefits of professional representation is immediate relief from aggressive recovery tactics.

How we stop harassment:

Buffer communication: Once you engage TrueSettle, all communication goes through us. Recovery agents stop contacting you directly, as we handle all discussions professionally.

Immediate cease letter: We send formal communication to your lender stating we represent you, all communication must be directed to us, and demanding cessation of harassment tactics per RBI guidelines.

Legal deterrent: Banks and recovery agents know professional firms understand borrower rights and won’t tolerate illegal tactics. They immediately shift to professional communication.

Mental peace: Clients report the relief from constant harassment calls and threats is worth the fee alone, allowing them to focus on arranging settlement funds rather than dealing with stress.

Crisis intervention: If you’re facing visits to your home, workplace harassment, or threats to family members, we intervene immediately and escalate to bank management and legal authorities if necessary.

Transparent, Success-Based Fees

Unlike some settlement firms that charge upfront regardless of outcome, TrueSettle operates on a success-based model aligned with your interests.

Our fee structure:

Zero upfront costs: We charge nothing to start your case, review your situation, or begin negotiations.

Success-based payment: Our fee is only due after we successfully negotiate your settlement and you receive confirmation.

Percentage of savings: We charge 15-25% of the amount saved through settlement, not a percentage of the outstanding loan. If we save you ₹3 lakhs on a ₹5 lakh loan, our fee is ₹45,000-75,000, and you still save ₹2.25-2.55 lakhs net.

No hidden charges: Our quoted fee includes everything—negotiation, documentation, follow-up, NOC verification. No surprise charges later.

Money-back guarantee: In the rare case we cannot achieve settlement, you owe nothing. Our incentive is completely aligned with yours.

Complete Settlement to Credit Rebuilding Support

Our service doesn’t end with loan settlement. We provide comprehensive support through the entire recovery process.

Beyond settlement, we provide:

Credit report review: We obtain and analyze your credit reports, identify errors, and file disputes on your behalf to ensure accurate reporting.

Credit rebuilding strategy: Based on your specific situation, we create a customized 18-24 month plan to rebuild your credit score to 720+.

Secured credit product guidance: We recommend specific secured credit cards and credit builder loans suitable for your recovery phase and assist with applications.

Ongoing monitoring: We check your credit reports at 3, 6, and 12 months post-settlement to ensure continued accuracy and track improvement.

Financial counseling: We provide guidance on budgeting, emergency fund building, and avoiding future debt problems.

Future credit support: When you’re ready to apply for new credit (typically 18-24 months later), we advise on timing, lenders more likely to approve, and documentation to present.

Proven Track Record

TrueSettle has helped over 5,000 borrowers across India settle more than ₹200 crores in personal loans, credit cards, and other unsecured debt.

Our success metrics:

Average settlement: 42% of outstanding amount (saving 58%)

Average case duration: 6-8 weeks from engagement to loan closure

NOC success rate: 98% of clients receive NOC within 45 days

Client satisfaction: 4.8/5 average rating from 500+ reviews

Harassment resolution: 100% success in stopping aggressive recovery tactics

Credit recovery: Clients achieve average 720+ score within 22 months

Frequently Asked Questions About Personal Loan Settlement

Can I negotiate personal loan settlement directly with my bank without professional help?

Yes, you absolutely can negotiate directly with your bank or NBFC. Many borrowers successfully settle loans independently by following the process outlined in this guide. However, professional services like TrueSettle typically achieve 10-20% better settlement terms due to established lender relationships, negotiation expertise, and knowledge of specific bank policies.

Consider DIY settlement if your loan is smaller (under ₹3 lakhs), you’re comfortable with negotiation, you have time to handle multiple rounds of discussion, and you’re not facing aggressive harassment. Professional help is advisable for larger loans (₹5 lakhs+), multiple lenders simultaneously, aggressive recovery tactics, or if initial DIY attempts aren’t achieving favorable terms.

How much can I realistically reduce my personal loan through settlement in 2024?

Settlement reductions typically range from 40-70% of total outstanding amount, depending on several factors. For loans severely in default (6+ months overdue), you can generally settle for 30-45% of outstanding (saving 55-70%). For recently defaulted loans (3-6 months), expect to pay 50-60% (saving 40-50%). Very recent defaults (under 3 months) may only achieve 70-80% settlement (saving 20-30%).

Other factors affecting settlement percentage include your documented financial hardship (stronger evidence = better terms), the lender’s specific policies (some are more flexible than others), your loan amount (larger loans sometimes get better percentages), and quarter-end timing (banks more flexible at Q4 and year-end). Professional negotiators typically achieve percentages 10-15% better than DIY attempts.

For example, a ₹5 lakh outstanding loan defaulted 8 months ago might settle for ₹1.8-2.2 lakhs (36-44%). The same loan defaulted only 2 months might require ₹3.5-4 lakhs (70-80%).

Will personal loan settlement permanently ruin my CIBIL score?

No, settlement damage is temporary, not permanent. Settlement typically reduces your CIBIL score by 75-100 points initially. For example, a 750 score might drop to 650-675. However, the account status “settled” remains on your credit report for 7 years, though its impact diminishes significantly over time.

With disciplined credit behavior—perfect payment records on any remaining accounts, keeping credit card utilization under 30%, using secured credit products responsibly, and avoiding new hard inquiries—most borrowers restore their scores to 720+ within 18-24 months.

The “settled” tag makes loan approval more difficult for 12-18 months and may result in higher interest rates for 24-36 months. However, it’s far better than continued default, which leads to legal action, and even more severe credit damage. Many borrowers successfully obtain loans 2-3 years after settlement, though often at slightly higher rates than prime borrowers.

The key is viewing settlement as a reset button—it damages credit temporarily but gives you a foundation to rebuild, whereas continued default spirals into worse consequences.

Is personal loan settlement legal in India, or will banks take legal action?

Personal loan settlement is completely legal in India and is a recognized mechanism for debt resolution between borrowers and lenders. The RBI provides guidelines for fair practices during loan recovery and settlement processes. Banks prefer settlement over legal action in most cases because litigation is expensive (legal fees, court costs), time-consuming (cases can take 3-5 years), uncertain (outcomes aren’t guaranteed), and resource-intensive (requires documentation, appearances, enforcement).

Settlement offers immediate partial recovery without these complications. However, banks may initiate or threaten legal action if you ignore communication attempts entirely, make no effort to settle or restructure, have significant assets they can recover, or default on very large loans (₹10 lakhs+).

To avoid legal action, initiate settlement discussions proactively before the account is severely delinquent, maintain regular communication showing good faith, present reasonable settlement offers backed by hardship documentation, and never ignore legal notices (respond with settlement proposals).

If legal action is filed, it’s not the end—you can still negotiate settlement even during proceedings. Many DRT and court cases end in negotiated settlements rather than judgments.

What documents do I need to negotiate loan settlement successfully?

Essential documents strengthen your negotiation position by proving genuine financial hardship. You’ll need proof of financial hardship such as medical bills and hospitalization records for serious illness, job termination or resignation letter showing employment loss, business closure certificates or GST cancellation if self-employed, or income tax returns showing significant income reduction.

Loan-related documents include complete loan account statement with outstanding principal, interest, and penalties breakdown, original loan agreement and sanction letter, EMI payment history, and correspondence with the bank (emails, letters, notices).

Identity and address proof needs PAN card (mandatory for financial transactions), Aadhaar card, current address proof (utility bill, rental agreement), and bank statements for the last 6 months showing financial position.

Additional supporting documents may include salary slips (if currently employed at reduced salary), property documents (if you own property but can’t liquidate), family income proof (showing household financial constraints), or dependency proof (elderly parents, children’s education expenses).

Strong documentation can improve settlement terms by 10-15%. It justifies your settlement request and demonstrates you’re acting in good faith due to genuine hardship, not simply avoiding payment.

Can banks legally reject my settlement offer?

Yes, banks have the right to reject settlement offers they consider insufficient or if they believe you have the capacity to pay more. However, rejection of your initial offer doesn’t end negotiations—it’s usually the starting point for counter-offers and discussion.

Banks typically reject offers when the proposed amount is unrealistically low (e.g., 20% for a recently defaulted loan), you haven’t provided adequate financial hardship documentation, they believe you have undisclosed assets or income capacity, your offer is made too early (before significant default period), or internal policies don’t permit the proposed percentage.

If your offer is rejected, request specific reasons for rejection and counter-offer explanation, present additional hardship documentation if available, ask what settlement percentage the bank would consider acceptable, propose structured payment if lump sum is an issue, or request escalation to a senior manager if the recovery agent seems inflexible.

Remember, multiple rounds of negotiation are normal. The first rejection isn’t final. Banks often reject initial offers but accept revised proposals that are 10-15% higher. Maintain patience and professional communication throughout the process.

How long does the complete personal loan settlement process take from start to finish?

The typical settlement timeline is 6-12 weeks from initial contact to final loan closure, but this varies based on several factors. Here’s a detailed breakdown:

Week 1-2 involves financial assessment, gathering documentation, and making initial contact with the lender’s settlement department. Week 2-4 covers submission of initial offer, back-and-forth negotiation rounds (typically 2-4 rounds), and receiving counter-offers and revising proposals. Week 4-5 focuses on reaching verbal agreement and obtaining written settlement agreement with all terms documented.

Week 5-6 includes arranging settlement funds (if not already available), making payment through proper traceable methods, and confirming payment receipt with the bank. Week 6-8 involves follow-up for NOC issuance (typically 15-30 days post-payment) and receiving loan closure certificate. Week 8-12 covers credit report verification and update confirmation and filing disputes if reporting is incorrect.

Factors that speed up the process include having settlement funds ready upfront, making reasonable initial offers, having strong hardship documentation, and engaging during quarter-end periods (higher bank flexibility).

Factors that slow down the process include severely defaulted loans (more complex approvals required), multiple back-and-forth negotiations, bank internal approval delays, incomplete documentation, and coordination issues with co-borrowers or guarantors.

Professional services like TrueSettle typically complete settlements 2-3 weeks faster than DIY attempts due to established processes and direct banking contacts.

What is the difference between loan settlement and loan restructuring? Which is better for me?

Loan settlement and restructuring are fundamentally different solutions for different situations, each with distinct impacts on your finances and credit.

Loan settlement involves paying a reduced lump sum (typically 30-60% of outstanding) to close the loan completely. It provides immediate debt relief but damages credit score (75-100 point drop typically) and remains on credit report for 7 years as “settled” status. It’s suitable when you have genuine financial hardship preventing continued payments, access to a lump sum amount, are willing to accept temporary credit damage, and want complete closure rather than continued debt.

Loan restructuring modifies repayment terms—extended tenure (same principal over longer period), reduced EMI (lower monthly payments), changed interest rate (negotiate lower rate), or moratorium period (payment pause for 3-6 months). The principal amount isn’t reduced, but payments become manageable. It has minimal credit score impact (may improve by avoiding default), is reported as “restructured” which is better than “settled,” and provides a path to full repayment.

Choose settlement when your financial situation is unlikely to improve soon (prolonged job loss, business closure, permanent disability), you cannot afford even reduced EMIs, you have a lump sum available, or you’re already in significant default (6+ months).

Choose restructuring when your financial difficulty is temporary (short-term job loss, temporary business downturn, one-time emergency), you can afford lower EMIs, you want to protect your credit score, or you haven’t defaulted yet or are in early default (under 3 months).

Can I get a new loan after settling my previous personal loan?

Yes, you can obtain new loans after settlement, though it becomes more challenging for 18-24 months. Here’s what to expect at different stages after settlement:

0-12 months post-settlement sees most traditional banks rejecting applications, very high rejection rates (80-90%), and if approved, significantly higher interest rates (5-7% above standard rates). This period requires secured products (FD-backed loans, gold loans) and focusing on credit rebuilding rather than new debt.

12-18 months post-settlement has improving but still difficult approval chances (60-70% rejection rate), some banks and NBFCs considering applications with additional conditions like co-applicant required, higher interest rates (3-5% above standard), and lower loan amounts (₹2-3 lakhs maximum typically).

18-24 months post-settlement shows moderate approval chances (40-50% rejection rate), digital lenders and NBFCs more flexible than traditional banks, interest rates normalizing (2-3% above standard), and improved loan amounts if credit score has recovered to 720+.

24+ months post-settlement demonstrates significantly improved approval chances with rebuilt credit, near-normal interest rates if score is 750+, and standard loan amounts based on income and eligibility.

To improve approval chances, rebuild credit score to 720+ before applying, maintain perfect payment records on all existing accounts, have stable employment (2+ years in current job), apply to digital lenders and NBFCs first (they have more flexible policies), be prepared to provide detailed explanation of past settlement, highlight improved financial situation since settlement, and avoid applying to multiple lenders simultaneously (damages score further).

Starting with smaller loans (₹50,000-1,00,000) and graduating to larger amounts demonstrates creditworthiness gradually.

Do I need to pay taxes on the loan amount that was written off during settlement?

The forgiven debt amount may be considered taxable income under certain circumstances. Indian tax law treats debt forgiveness as “income from other sources” under Section 56 of the Income Tax Act, potentially making the waived amount taxable at your applicable tax slab.

However, there are important exceptions and nuances. The tax liability depends on whether you’re insolvent (liabilities exceed assets), the nature of hardship, and specific circumstances of settlement. For genuine financial hardship with documented insolvency, the waived amount may not be taxable. Personal bankruptcies or insolvency proceedings typically provide exemptions.

Tax implications vary by case, and this is a complex area of tax law where professional advice is essential. It’s advisable to consult with a chartered accountant or tax consultant before finalizing settlement, understand potential tax liability in advance, factor any tax obligations into your settlement negotiation, and maintain comprehensive documentation of your financial hardship to support exemption claims if questioned by tax authorities.

The tax liability, if applicable, is typically far less than the benefit of settling debt. For example, if you settle a ₹5 lakh loan for ₹2 lakhs (saving ₹3 lakhs), even if the ₹3 lakh waiver is taxed at 30%, you’d pay ₹90,000 in tax but still save ₹2.1 lakhs net. TrueSettle can connect you with tax consultants who specialize in debt settlement tax implications.

What if the bank refuses to provide a written settlement agreement before payment?

Never make settlement payment without comprehensive written documentation, regardless of pressure or verbal assurances. This is a critical, non-negotiable principle. If a bank or recovery agent refuses written agreement, this is a major red flag indicating potential issues.

Banks refusing written agreements may be unauthorized (recovery agent making offers beyond their authority), planning to claim different terms later (verbal offers not honored after payment), not serious about settlement (just extracting payment), or violating standard banking practices (legitimate settlements always have documentation).

If you encounter refusal for written agreement, take these steps: escalate immediately to the branch manager or settlement department head (don’t negotiate with recovery agents), send formal written request via email stating “I’m prepared to settle for ₹X as discussed, but require written agreement before payment as per standard banking practice,” reference RBI fair practice guidelines requiring transparent documentation, threaten to file complaint with Banking Ombudsman for refusal to provide proper documentation, and insist on email from official bank domain (not personal email) confirming all terms.

If the bank continues refusing written agreement, do not proceed with payment—walk away and explore other options, file formal complaint with bank’s grievance cell, approach the Banking Ombudsman with your documentation of offers and refusal, or consult with a consumer lawyer or debt settlement professional like TrueSettle.

Legitimate banks and NBFCs always provide written settlement agreements. Refusal indicates either unauthorized negotiation or intent to exploit you. Protect yourself by never making settlement payments based solely on verbal assurances, regardless of pressure or threats.

Take Action Today: Your Path to Financial Freedom

If you’re struggling with personal loan repayment, facing constant recovery calls, worried about legal action, or feeling overwhelmed by mounting debt, you don’t have to face this alone. Personal loan settlement offers a legal, effective path to reduce your debt burden by 40-60% and close your loan permanently.

The strategies outlined in this guide have helped thousands of borrowers across India negotiate favorable settlements, stop harassment, and rebuild their financial lives. Whether you choose to negotiate independently or seek professional assistance, the key is taking action promptly—waiting only reduces your leverage and increases stress.

Ready to Start Your Settlement Journey?

TrueSettle specialises in personal loan settlement, credit card debt resolution, and anti-harassment legal support. Our experienced team has helped over 5,000 borrowers settle more than ₹200 crores in debt, achieving an average 58% reduction in outstanding amounts.

What you get with TrueSettle:

✅ Expert negotiation with all major banks and NBFCs

✅ Legal protection and comprehensive documentation

✅ Immediate harassment prevention

✅ Zero upfront fees—pay only on successful settlement

✅ Complete support from negotiation through credit rebuilding

✅ Average 42% settlement (vs 50-60% DIY attempts)

📞 Schedule Your Free Consultation Today

Our debt resolution specialists will review your situation, assess settlement feasibility, explain the complete process transparently, estimate realistic settlement amounts and timelines, and answer all your questions with no obligation.

Contact TrueSettle:

🌐 Website: www.TrueSettle.in

📞 Phone: 8588808825

📧 Email: info@truesettle.in

💬 WhatsApp: https://wa.me/918588808825

Don’t let debt control your life. Take the first step toward financial freedom today.

Disclaimer: TrueSettle provides loan settlement consulting and advisory services only. We do not provide loans, credit facilities, or legal representation in court proceedings. All settlement negotiations are conducted in strict compliance with RBI guidelines and applicable laws. Loan settlement will impact your credit score and future borrowing capacity. We recommend consulting with tax professionals regarding the potential tax implications of debt forgiveness. Every settlement case is unique, and outcomes depend on individual circumstances, lender policies, and negotiation factors. Past results do not guarantee future outcomes.

This article was reviewed and verified by TrueSettle’s financial advisory team with over 10 years of combined experience in debt resolution, banking operations, and consumer finance law. Last updated: December 2024.