Struggling with multiple loans or mounting debt? You’re not alone. As we navigate through 2026, financial challenges continue to affect millions of Indian borrowers. Understanding the difference between loan settlement, loan closure, and debt consolidation can be the key to making informed decisions about your financial future.

Loan Settlement vs Loan Closure vs Debt Consolidation – Key Differences Explained

In this comprehensive guide, we’ll break down these three distinct approaches to managing debt in the Indian context, helping you determine which option aligns best with your financial situation.

What is Loan Closure?

Loan closure is the most straightforward and favorable way to end your loan agreement. It occurs when you repay the entire loan amount along with all applicable interest and charges according to the original loan terms.

Key Features of Loan Closure:

Complete Repayment: You pay 100% of the outstanding principal, interest, and any applicable fees.

Positive CIBIL Impact: Loan closure is reported as “Closed” or “Paid in Full” on your CIBIL report and other credit bureaus (Experian, Equifax, CRIF High Mark), which positively affects your credit score.

No Negotiation Required: You simply fulfill your contractual obligation as agreed upon at the loan’s inception.

Clean Credit Record: Your repayment history remains intact, demonstrating financial responsibility to future lenders including banks, NBFCs, and fintech lenders.

No Foreclosure Charges: As per RBI guidelines, banks cannot charge foreclosure charges on floating rate personal loans and home loans taken by individual borrowers.

When Should You Choose Loan Closure?

Loan closure is ideal when you have the financial means to pay off your debt completely. This might happen through salary bonuses, inheritance, maturity of fixed deposits, PPF withdrawals, or successful savings strategies. It’s always the preferred option from both a CIBIL score and financial health perspective.

What is Loan Settlement?

Loan settlement, also known as debt settlement or one-time settlement (OTS), involves negotiating with your lender to pay less than the total amount owed. This option typically comes into play when you’re facing genuine financial hardship and cannot meet your original loan obligations.

How Loan Settlement Works in India:

Negotiation Process: Either you or a debt settlement professional negotiates with lenders (banks, NBFCs, or collection agencies) to accept a reduced payment as full settlement of the debt.

Partial Payment: You typically pay 30-60% of the outstanding amount, though this varies based on your financial situation, loan type, and the lender’s internal policies.

Legal Agreement: Once agreed upon, you receive a written settlement agreement (often called an OTS letter) specifying the reduced amount and confirming that this payment resolves the debt.

No Objection Certificate: After payment, obtain a No Dues Certificate or NOC from the lender confirming complete closure of the account.

CIBIL Score Impact of Loan Settlement:

This is where loan settlement becomes tricky in India. Your credit report will show the account as “Settled” or “Written Off – Settled,” which can:

- Significantly lower your CIBIL score (potentially by 75-100 points or more)

- Remain on your credit report for up to seven years from the date of settlement

- Make it extremely difficult to secure future loans or credit cards from banks

- Result in rejection of loan applications or higher interest rates if approved

- Affect your ability to get home loans, car loans, and even credit cards

When to Consider Loan Settlement:

Loan settlement may be appropriate if you’re experiencing severe financial hardship such as job loss, medical emergencies, business failure, or prolonged illness, and you have no realistic means to pay the full debt amount. It’s better than defaulting completely or being declared a wilful defaulter, but it should be a last resort.

What is Debt Consolidation?

Debt consolidation is a proactive debt management strategy where you combine multiple debts into a single loan, ideally with better terms. Rather than eliminating debt, you’re restructuring it for easier management.

How Debt Consolidation Works in India:

Single Loan Application: You take out a new loan (often called a debt consolidation loan or personal loan for debt consolidation) large enough to pay off multiple existing debts.

Pay Off Multiple Creditors: The new loan proceeds are used to close all your existing debts including credit cards, personal loans, and other unsecured loans.

One Monthly Payment: Instead of juggling multiple EMIs with different due dates and interest rates, you make one consolidated EMI payment.

Potentially Better Terms: The consolidation loan may offer a lower interest rate, extended repayment tenure, or both.

Types of Debt Consolidation Options in India:

Personal Consolidation Loan: An unsecured loan from banks like HDFC, ICICI, SBI, Axis Bank, or NBFCs like Bajaj Finance, Tata Capital.

Balance Transfer on Credit Cards: Transferring multiple credit card outstanding balances to one card with lower interest or special balance transfer offers.

Loan Against Property (LAP): Using your property as collateral to secure a loan for debt payoff at lower interest rates (carries risk of property seizure).

Gold Loan: Using gold jewelry as collateral for quick debt consolidation at competitive rates.

Top-up on Existing Home Loan: If you have an existing home loan with good repayment history, you can avail a top-up at home loan rates.

Benefits of Debt Consolidation:

- Simplifies finances with one monthly EMI

- Can reduce overall interest rates significantly (personal loans are 10-24% while consolidation might offer 9-18%)

- May lower monthly payment amounts through extended tenure

- Helps avoid missed payments and late fees

- Can improve CIBIL score over time with consistent payments

- No negative “settlement” notation on credit report

- Better financial planning with predictable monthly outflow

Drawbacks to Consider:

- May extend the time you’re in debt

- Could result in paying more interest over the loan lifetime despite lower rates

- Requires good to excellent CIBIL score (typically 750+) for best rates

- Risk of accumulating new debt if spending habits don’t change

- Processing fees and other charges apply (typically 1-3% of loan amount)

- Secured loans like LAP carry risk of asset loss

Loan Settlement vs Loan Closure vs Debt Consolidation: Side-by-Side Comparison

Total Amount Paid:

- Loan Closure: 100% of the debt

- Loan Settlement: 30-60% of the debt (varies)

- Debt Consolidation: 100% of the debt, potentially with reduced interest

CIBIL Score Impact:

- Loan Closure: Positive impact (score improves by 20-50 points)

- Loan Settlement: Severe negative impact (drops by 75-100+ points, stays for 7 years)

- Debt Consolidation: Neutral to positive (if managed responsibly)

Timeline:

- Loan Closure: Immediate (once payment is made, NOC in 7-15 days)

- Loan Settlement: 2-6 months for negotiation and payment

- Debt Consolidation: Ongoing (new loan tenure, typically 1-7 years)

Best For:

- Loan Closure: Those with sufficient funds to pay off debt completely

- Loan Settlement: Those facing severe financial hardship with no ability to pay full amount

- Debt Consolidation: Those with multiple debts who need simplified repayment structure and good CIBIL score

Future Borrowing:

- Loan Closure: Easiest to secure future credit

- Loan Settlement: Extremely difficult to secure credit for several years

- Debt Consolidation: Maintains borrowing potential if managed well

Documentation Required:

- Loan Closure: Loan account statement, final payment receipt, NOC

- Loan Settlement: Financial hardship proof, income documents, OTS agreement, NOC

- Debt Consolidation: Income proof, bank statements, existing loan details, CIBIL report

Making the Right Choice for Your Financial Situation

Choosing between these three options depends on your unique circumstances. Ask yourself these questions:

Do you have the means to pay off your debt in full? If yes, loan closure is always your best option. It protects your CIBIL score and demonstrates financial responsibility.

Are you overwhelmed by multiple EMIs with varying interest rates? If you have steady income but struggle with organization and high interest rates, debt consolidation might streamline your finances effectively.

Are you facing genuine financial hardship with no foreseeable ability to meet your obligations? If you’ve exhausted all other options and face severe consequences, loan settlement might be worth considering despite its CIBIL impact.

Steps to Take Before Making Your Decision

Before choosing any debt relief strategy, consider these important steps:

- Assess Your Complete Financial Picture: List all debts, income sources (salary, business income, rental income), and monthly expenses to understand your true situation.

- Check Your CIBIL Score: Get a free CIBIL report from CIBIL.com, Paisabazaar, or BankBazaar to understand your current credit standing.

- Calculate Total Costs: For each option, calculate the total amount you’ll pay, including processing fees, GST, and interest.

- Consult a Financial Advisor: Professional guidance can help you navigate complex decisions and avoid costly mistakes.

- Understand Tax Implications: Under the Income Tax Act, forgiven debt through settlement may be considered income from other sources and be taxable.

- Review RBI Guidelines: Understand your rights as a borrower under RBI’s Fair Practices Code for lenders.

- Contact Your Lenders: Many banks and NBFCs offer restructuring options, moratorium periods, or modified payment plans under financial hardship.

- Consider Credit Counseling: Organizations like Credit Counselling Centres in India (authorized by RBI) offer free debt counseling services.

Understanding RBI Guidelines on Loan Settlement

The Reserve Bank of India has specific guidelines that protect borrowers:

- Fair Practices Code: All banks and NBFCs must follow RBI’s Fair Practices Code, which includes transparent communication about settlement options.

- Recovery Practices: Lenders and recovery agents must follow dignified recovery practices. Harassment, threatening behavior, or visits at odd hours are prohibited.

- Restructuring Options: During financial stress, borrowers can request loan restructuring before resorting to settlement.

- Foreclosure Rules: No foreclosure charges on floating rate loans for individuals, though processing fees may apply on fixed-rate loans.

- Grievance Redressal: If you face unfair practices, you can approach the Banking Ombudsman or RBI’s complaint portal.

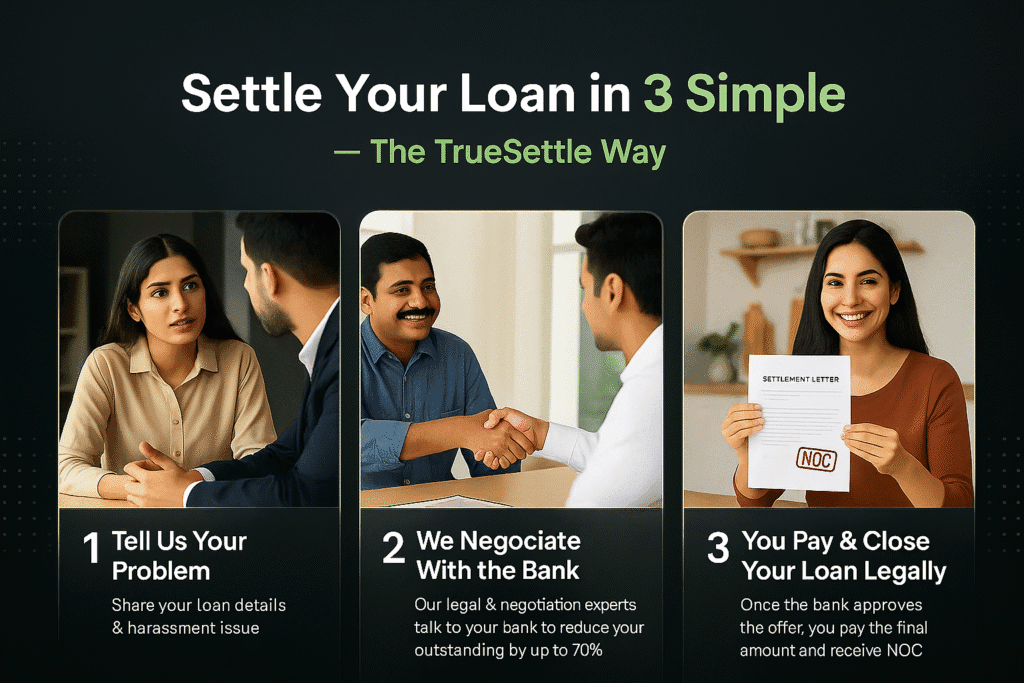

Truesettle’s Expert Perspective

At Truesettle, we understand that managing debt in India’s complex financial landscape can be overwhelming and confusing. Each financial situation is unique, and what works for one person may not be suitable for another. Our team of legal and financial experts specializes in helping Indian borrowers navigate these complex decisions, ensuring you understand both the immediate and long-term implications of each approach.

Whether you’re considering loan settlement with banks and NBFCs, working toward loan closure, or exploring debt consolidation options, professional guidance can make the difference between financial recovery and prolonged hardship. We’re committed to providing transparent, ethical advice that complies with RBI guidelines and prioritizes your long-term financial health and CIBIL score.

Frequently Asked Questions (FAQs)

1. Will loan settlement affect my ability to get a home loan in India?

Yes, loan settlement will severely impact your ability to secure a home loan in India. Most banks view a “Settled” status on your CIBIL report very unfavorably, as it indicates you didn’t fulfill your original obligation. Major lenders like SBI, HDFC Bank, ICICI Bank, and Axis Bank typically reject loan applications with settlement marks. The settlement notation remains on your CIBIL report for seven years from the settlement date. You may still qualify for a home loan from select NBFCs, but you’ll face significantly higher interest rates (often 2-4% higher) and stringent eligibility criteria. It’s advisable to wait at least three to four years after settlement and actively rebuild your CIBIL score above 750 before applying for a home loan.

2. Can I negotiate a loan settlement on my own, or do I need a professional?

You can certainly negotiate a loan settlement on your own in India without hiring a debt settlement company. Many borrowers successfully negotiate directly with their bank’s or NBFC’s collections department by explaining their financial hardship with supporting documents (medical bills, job termination letter, business closure proof). However, professional debt settlement services like Truesettle bring expertise in RBI guidelines, established relationships with lenders’ recovery teams, and negotiation skills that might secure better settlement percentages (40% vs 60%). If you choose DIY settlement, ensure you get the OTS agreement in writing, obtain a No Dues Certificate after payment, and understand the Income Tax implications before accepting any settlement offer.

3. How much does debt consolidation typically cost in India?

The cost of debt consolidation in India varies depending on the method and lender you choose. Personal consolidation loans from banks typically charge processing fees ranging from one to three percent of the loan amount plus 18% GST. For example, on a ₹5 lakh consolidation loan with 2% processing fee, you’ll pay ₹10,000 + ₹1,800 GST = ₹11,800 upfront. Balance transfer on credit cards often charges zero processing fees during promotional periods but regular balance transfer fees range from 1-3% of the transferred amount. Loan Against Property has lower processing fees (0.5-1%) but requires legal and technical valuation charges (₹5,000-₹15,000). Always calculate the total cost including interest over the entire tenure to ensure consolidation actually saves you money.

4. Is debt consolidation worth it if I have a low CIBIL score?

Debt consolidation can still be beneficial with a low CIBIL score (below 650), but your options will be limited and costlier. Most premier banks require a minimum CIBIL score of 750 for personal loans at competitive rates (11-14% p.a.). With a score between 600-700, you might qualify through NBFCs like Bajaj Finance, Fullerton India, or Tata Capital, but expect higher interest rates (16-24% p.a.). If your CIBIL is below 600, consider secured options like Gold Loan (offers 7-12% interest with minimal CIBIL checks) or Loan Against Property. Alternatively, focus first on improving your CIBIL score through timely credit card payments and clearing small outstanding amounts before applying for consolidation. Some fintech lenders also offer consolidation to low-CIBIL borrowers but at premium rates.

5. What’s the difference between debt settlement companies and debt consolidation services in India?

Debt settlement companies in India negotiate with your creditors to reduce the total amount you owe, typically by 40-70%. They often advise you to stop making EMI payments and instead save money to fund the eventual settlement offer. This approach severely damages your CIBIL score and attracts late payment charges. Debt consolidation services, on the other hand, help you obtain a new loan to pay off existing debts in full, or facilitate balance transfers. You continue making regular payments, which protects your CIBIL score. Settlement is suitable only for severe financial hardship (job loss, medical emergency, business failure), while consolidation is for managing multiple high-interest debts more efficiently. Beware of companies charging huge upfront fees; legitimate settlement services charge fees only after successful settlement.

6. How long does loan settlement take to complete in India?

The loan settlement process in India typically takes between two to six months, though complex cases involving multiple lenders can take longer. The timeline depends on your financial hardship documentation quality, the lender’s internal settlement policies (PSU banks are slower than private banks/NBFCs), your negotiation leverage, and the outstanding amount. For example, credit card settlements often process faster (1-3 months) compared to personal loan settlements (3-6 months). Once you and your lender agree on OTS terms, you typically have 30-90 days to arrange the settlement amount. After payment, the lender updates CIBIL within 30-45 days, but this can extend to 60-90 days. The “Settled” status then remains visible on your CIBIL report for seven years from the settlement date.

7. Will my CIBIL score improve after debt consolidation?

Yes, debt consolidation can improve your CIBIL score over time if managed properly, but expect an initial temporary dip of 5-15 points. When you apply for a consolidation loan, the hard inquiry from lenders impacts your score. However, once you use the loan to pay off multiple credit cards and personal loans, several positive factors emerge: your credit utilization ratio improves dramatically (using only 30% of available credit boosts scores), you demonstrate ability to handle larger credit amounts, and consistent EMI payments build positive payment history. Many Indian borrowers see CIBIL score improvements of 30-70 points within six to twelve months of successful debt consolidation. The key is making timely payments—even one 30-day delay can reverse gains.

8. Can I settle a loan that’s already been written off by the bank?

Yes, you can definitely settle a loan that has been written off by a bank in India. A “write-off” or “written-off” status means the bank has removed the loan from their active books for accounting purposes (usually after 180-360 days of non-payment), but you still legally owe the money. Banks often transfer written-off accounts to their internal recovery teams or sell them to Asset Reconstruction Companies (ARCs) or debt collection agencies. These entities are usually more willing to negotiate aggressive settlements (30-50% of outstanding) because they’ve purchased the debt at a discount. However, settling a written-off account doesn’t remove the “written-off” status from your CIBIL; it updates to “written-off-settled,” which remains for seven years and is still viewed negatively by lenders.

9. What happens if I miss an EMI on my debt consolidation loan?

Missing an EMI on your debt consolidation loan in India has serious consequences. First, you’ll incur late payment charges (typically ₹500-₹1,000 per missed EMI) plus penal interest (additional 2-4% per annum on the overdue amount). More critically, the missed payment is reported to CIBIL and other credit bureaus within 30 days, immediately dropping your score by 50-80 points. Banks typically report: “30 days past due” (DPD 30), “60 DPD,” “90 DPD,” and “90+ DPD” progressively. After 90 days of non-payment, your loan may be classified as NPA (Non-Performing Asset), severely damaging your credit profile. Your loan could go into default after 180 days, potentially resulting in legal action. Contact your lender immediately if facing payment difficulties; many offer restructuring or moratorium options for genuine hardship cases.

10. Is the forgiven amount in a loan settlement taxable in India?

Yes, under the Income Tax Act, the amount waived or forgiven through loan settlement is generally considered “income from other sources” and is taxable at your applicable income tax slab rate. If your lender waives ₹2 lakh or more, they may issue you a Form 16A or report it to the Income Tax Department. For example, if you owed ₹5 lakh and settled for ₹2 lakh, the waived ₹3 lakh could be added to your taxable income for that financial year. However, there are grey areas and potential exemptions if you can prove insolvency (liabilities exceed assets) at the time of settlement. This tax liability often surprises borrowers and can be substantial (30% tax slab means ₹90,000 tax on ₹3 lakh waiver). Consult a chartered accountant before proceeding with settlement to understand your specific tax implications.

11. Can I do loan closure even if I’ve already missed several EMIs?

Yes, you can absolutely pursue loan closure even after missing multiple EMIs in India, though you’ll need to pay the complete outstanding amount including the principal, accumulated interest, late payment charges, penal interest, and any bounce charges (if NACH/ECS failed). While your payment history showing DPD (Days Past Due) entries will remain on your CIBIL report for seven years, closing the loan properly by paying it in full is significantly better than leaving it in default or settling for less. The “Closed” status with DPD history still looks much better to future lenders than “Settled” or “Written Off.” Many banks offer special closure schemes where they waive late payment charges if you clear the principal and interest. Contact your lender’s customer service or visit the branch to get a closure statement with the exact amount needed.

12. What CIBIL score do I need for debt consolidation loan approval in India?

CIBIL score requirements for debt consolidation in India vary across lenders. For premier banks like HDFC, ICICI, Axis, and SBI offering competitive interest rates (10.5-14% p.a.), you typically need a minimum CIBIL score of 750+. Public sector banks like SBI, PNB, and Bank of Baroda may approve applications with scores of 700-750 but at slightly higher rates (13-16% p.a.). NBFCs like Bajaj Finance, Fullerton India, and Tata Capital approve loans for CIBIL scores between 650-700, but interest rates increase to 16-20% p.a. Below 650, approval chances diminish significantly unless you opt for secured consolidation like Loan Against Property or Gold Loan, which have more relaxed CIBIL requirements (600+) due to collateral security. Some new-age fintech lenders like MoneyTap, EarlySalary, or KreditBee may approve unsecured consolidation for scores above 600 but at premium rates exceeding 20% p.a.

13. Will banks give me a new loan after I’ve settled an old one?

Getting a new loan after settling an old one is extremely challenging but not impossible in India. Most major banks (SBI, HDFC, ICICI, Axis, Kotak) have strict policies rejecting applicants with settlement marks on their CIBIL report, especially within the first 3-4 years post-settlement. However, your chances improve if: you wait at least 3-5 years after settlement, rebuild your CIBIL score to 750+ through credit cards and timely payments, demonstrate stable income with 2-3 years of consistent employment, maintain good banking relationships with savings accounts and fixed deposits, and provide explanations with supporting documents for the original financial hardship. Select NBFCs, fintech lenders, and housing finance companies may consider applications with settlements after 2-3 years, but at significantly higher interest rates (4-6% premium). Secured loans like LAP or gold loans are easier to obtain post-settlement than unsecured loans.

14. What documents do I need to apply for loan settlement in India?

To apply for loan settlement with banks or NBFCs in India, you’ll typically need the following documents to prove genuine financial hardship: income proof (latest 3 months’ salary slips or zero-income declaration if unemployed), bank statements of the last 6 months showing financial distress, financial hardship supporting documents (medical bills for illness, job termination letter, business closure documents, death certificate of earning family member), PAN card and Aadhaar card for identity verification, outstanding loan statement from the lender, a formal hardship letter explaining your situation and inability to repay, settlement proposal letter stating the amount you can pay, property and asset declaration showing you have no hidden assets, and income tax returns of the last 2 years if applicable. The more comprehensive your documentation proving genuine hardship, the better your chances of negotiating a favorable settlement percentage with your lender.

15. Can loan settlement help me avoid legal action from banks in India?

Yes, loan settlement can definitely help you avoid legal action from banks and NBFCs in India, but you must act before the situation escalates too far. Banks typically initiate legal proceedings under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act or file civil suits after 6-12 months of consistent default. If you proactively approach your lender within the first 3-6 months of default and negotiate a settlement, most banks prefer this route as legal action is time-consuming and expensive for them. However, once legal notice has been issued under Section 13(2) of SARFAESI Act or a civil suit is filed, settlement becomes more difficult (though still possible). For secured loans like home loans and LAP, banks can seize and auction your property after proper notice under SARFAESI. Settlement protects you from: property seizure, legal costs (court fees, lawyer charges), public auction embarrassment, wilful defaulter tag, and criminal complaints in some cases. Always consult with legal and financial experts like Truesettle when facing legal threats.

Conclusion: Your Path to Financial Freedom in India

Understanding the differences between loan settlement, loan closure, and debt consolidation empowers you to make informed decisions about your financial future in India’s dynamic lending environment. While loan closure is always the ideal scenario for protecting your CIBIL score, both debt consolidation and loan settlement serve important purposes for borrowers facing different challenges.

Remember, taking action is crucial. Ignoring debt problems only makes them worse—leading to damaged CIBIL scores, legal action, and immense stress. Assess your situation honestly, understand your rights under RBI guidelines, explore all available options, and seek professional guidance when needed. Your journey to financial freedom begins with informed decision-making and a clear understanding of the tools available to you.

The Indian credit system, governed by RBI regulations and reported through CIBIL, Experian, Equifax, and CRIF High Mark, offers both challenges and opportunities for debt management. Whether you’re dealing with credit cards, personal loans, home loans, or business loans, there’s a path forward that can help you regain financial stability.

If you’re struggling with debt and need expert guidance on which approach is right for your specific situation—whether it’s negotiating with PSU banks, private banks, NBFCs, or understanding your CIBIL impact—contact Truesettle today. Our experienced team is ready to help you chart a course toward financial stability and peace of mind, while ensuring compliance with all RBI guidelines and protecting your legal rights as a borrower.