Struggling to keep up with loan EMIs? You’re not alone. Thousands of borrowers across India face financial hardship every year, and many don’t realise that negotiating a loan settlement with their bank is a legitimate option. While it’s not the ideal solution, a well-negotiated settlement can help you escape the debt trap legally and reduce your outstanding burden significantly.

In this guide, we’ll walk you through the entire loan settlement negotiation process—from understanding what settlement means to executing smart tactics that improve your chances of success.

What is Loan Settlement?

Loan settlement, also called “one-time settlement” (OTS), is an agreement between you and your lender where the bank agrees to accept a lump sum payment that’s less than your total outstanding debt. In exchange, they close your loan account and waive the remaining balance.

When is Settlement Considered?

Banks typically consider settlement proposals when:

- You’ve defaulted on EMI payments for 90+ days

- You demonstrate genuine financial hardship

- Legal recovery appears time-consuming or costly for the bank

- You can offer a reasonable lump sum amount

How it Impacts Credit Score

Here’s the reality: loan settlement will negatively impact your CIBIL score. The account gets marked as “settled” rather than “closed,” signalling to future lenders that you didn’t repay the full amount. Your score may drop by 75-100 points, and this status remains on your credit report for seven years.

However, settlement is still better than continued defaults, legal action, or a complete write-off on your credit report.

When Should You Try Negotiating a Loan Settlement?

Settlement isn’t for everyone. It’s a strategic option when you’re facing genuine financial distress but can arrange a lump sum amount.

Valid Financial Hardship Scenarios

Consider negotiating a settlement if you’re experiencing:

- Job loss or significant income reduction with no immediate recovery prospects

- Medical emergencies that have drained your savings

- Business closure or failure affecting your repayment capacity

- Multiple loan defaults creating an unmanageable debt burden

- Family emergencies requiring urgent financial resources

If you’re simply looking to avoid paying your full debt without genuine hardship, banks are unlikely to entertain your settlement request.

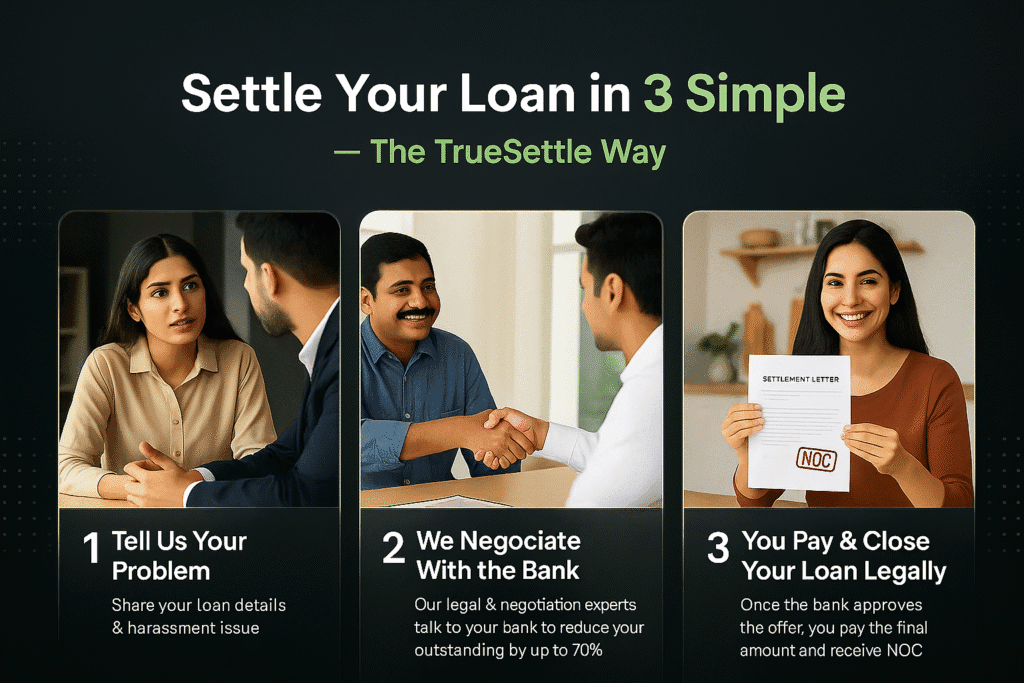

Step-by-Step Process to Negotiate Settlement with a Bank

Step 1: Assess Your Outstanding Debt

Before approaching the bank, get clarity on:

- Total principal amount remaining

- Accumulated interest and penalties

- Any legal or recovery charges added

- Current overdue amount

Request a detailed statement from your bank. This becomes your baseline for negotiation.

Step 2: Stop Unnecessary Communication

Once you’ve decided to pursue settlement, avoid giving vague promises to collection agents. Politely inform them that you’re preparing a settlement proposal and will contact the bank’s official settlement desk directly.

Keep all communication formal and documented. Avoid emotional conversations or making commitments you can’t keep.

Step 3: Prepare a Hardship Explanation

Draft a brief, honest explanation of your financial situation. Include:

- What caused your inability to pay (job loss, medical emergency, etc.)

- Your current income and monthly obligations

- Why settlement is your only viable option

- Supporting documents (termination letter, medical bills, business closure proof)

Transparency builds credibility with the settlement team.

Step 4: Make a Realistic Lump Sum Offer

Banks typically settle for 40-70% of the outstanding amount, depending on:

- How long the account has been in default

- The total amount involved

- Your negotiation skills

- The bank’s recovery cost projections

Start with a lower offer (30-40% of outstanding), expecting counter-offers. Have your maximum limit clear in your mind before negotiating.

Step 5: Negotiate & Get Written Confirmation

Once you reach verbal agreement:

- Request a written settlement letter on bank letterhead

- Ensure it clearly states the settled amount, waiver details, and closure confirmation

- Verify that it mentions “full and final settlement”

- Get a no-dues certificate after payment

Never make payment without written confirmation. Verbal promises mean nothing in financial transactions.

Sample Scripts for Negotiation

Script for First Conversation

“Hello, I’m calling regarding my loan account [Account Number]. Due to [specific reason – job loss/medical emergency], I’ve been unable to continue EMI payments. I want to resolve this responsibly. I can arrange a lump sum of ₹[amount], which is [percentage]% of my outstanding balance. I’d like to discuss a one-time settlement. Can you connect me with your settlement department?”

Script for Counter-Offer

“I appreciate your response. However, my current financial situation limits me to ₹[your amount]. I’ve liquidated all available assets to arrange this amount. This is the maximum I can offer for settlement. If this works, I’m ready to make payment within [timeframe] once I receive written confirmation.”

Key tip: Stay calm, factual, and firm. Don’t get emotional or aggressive. Remember, the bank wants to recover something rather than nothing.

Smart Tactics That Improve Your Settlement Chances

- Timing matters: Banks are more willing to settle near financial year-end (March) or quarter-end when they’re closing books and want to clear NPAs.

- Negotiate with decision-makers: Skip junior collection agents. Ask to speak with the settlement desk, recovery department head, or branch manager.

- Demonstrate payment readiness: Showing you have funds ready (bank statement, FD proof) increases your leverage.

- Be persistent but professional: One call won’t seal the deal. Follow up regularly, maintain records of all conversations, and send written communication via email.

- Consider smaller loans first: If you have multiple loans, settle smaller ones first to build your credibility with the bank.

- Avoid third-party negotiators initially: Try direct negotiation first. If unsuccessful, then consider professional help.

Mistakes to Avoid During Loan Settlement

Don’t ignore legal notices: Settlement is your best option before legal action escalates. Respond promptly to bank communications.

Don’t accept verbal agreements: Always get written confirmation before making any payment. Verbal promises have zero legal value.

Don’t pay in cash: Use banking channels (NEFT/RTGS/demand draft) for complete payment trail.

Don’t assume settlement erases the record: The “settled” status will appear on your credit report. Factor this into your decision.

Don’t borrow to settle: Taking a new loan to settle an old one rarely makes financial sense unless you’re getting significantly better terms.

Don’t share OTPs or bank details: Beware of fraudsters posing as settlement agents. Banks will never ask for OTPs or net banking passwords.

Legal & RBI Guidelines Borrowers Should Know

The Reserve Bank of India (RBI) has specific guidelines governing loan settlements:

- Fair Practice Code: Banks must follow fair practices and cannot harass borrowers during recovery.

- No coercion: Physical threats, abusive language, or visiting your workplace are prohibited.

- Transparency: Banks must clearly communicate settlement terms in writing.

- Grievance redressal: If you face harassment, you can file complaints with the Banking Ombudsman.

Remember: Loan settlement is completely legal. You’re not committing fraud by negotiating a reduced payment due to genuine hardship.

After Settlement: Rebuilding Your Credit Score

Once your loan is settled, focus on credit repair:

- Obtain all closure documents: No-dues certificate, settlement letter, and account closure confirmation.

- Verify credit report update: Check CIBIL, Experian, and Equifax to ensure the account shows “settled.”

- Start rebuilding: Apply for a secured credit card after 6-12 months, maintain 100% on-time payments, and keep credit utilization below 30%.

- Avoid new loans immediately: Give yourself at least 12-18 months before applying for major credit.

Rebuilding takes time, but consistent financial discipline can gradually restore your creditworthiness.

Final Thoughts

Negotiating a loan settlement with a bank in India requires preparation, patience, and persistence. While settlement does impact your credit score, it’s often the most practical solution when you’re facing genuine financial hardship.

The key is approaching the process strategically: assess your situation honestly, prepare documentation, negotiate professionally, and—most importantly—get everything in writing before making payment.

If you’re feeling overwhelmed by debt and collection calls, remember that settlement is a legitimate path forward. Don’t wait until legal action begins. Take control of the situation today.

Frequently Asked Questions

Q1. Can I legally negotiate a loan settlement in India?

Yes, loan settlement is completely legal in India. RBI guidelines allow banks to settle loans with borrowers facing genuine financial hardship. However, the settlement will be marked on your credit report, affecting your future borrowing capacity.

Q2. How much discount can I expect on loan settlement?

Typically, banks settle for 40-70% of the outstanding amount. The discount depends on factors like default duration, loan amount, your negotiation approach, and the bank’s internal policies. Older defaults often get higher discounts.

Q3. Does settlement affect my CIBIL score?

Yes, settlement negatively impacts your CIBIL score. The account gets marked as “settled” rather than “closed,” which remains on your report for seven years. However, it’s better than continued defaults or legal write-offs.

Q4. What documents should I collect after settlement?

After settlement, obtain: (1) Written settlement letter on bank letterhead, (2) No-dues certificate, (3) Account closure confirmation, (4) Payment receipts, and (5) Letter confirming waiver of remaining balance. Keep physical and digital copies.

Q5. Is hiring a settlement advisor helpful?

If direct negotiation fails, a professional advisor can help, especially for large loan amounts. However, try direct negotiation first. Be cautious of fraudulent agents—only work with registered legal or financial advisors and never pay hefty upfront fees.

Need expert guidance before you negotiate? Avoid costly mistakes and understand your legal rights. Professional advice can save you thousands while protecting your interests throughout the settlement process.