If you’ve ever wondered “what happens if I default on a loan in India,” you’re not alone. Thousands of borrowers face financial difficulties every month, and understanding the legal framework around debt recovery isn’t just helpful—it’s essential for protecting yourself.

This guide breaks down the debt recovery process in India, the legal actions lenders can take, and most importantly, what rights you have as a borrower when facing recovery pressure.

What Is Debt Recovery and Who Is a Loan Defaulter?

Before diving into the legal maze, let’s clarify the basics.

Debt is any financial obligation where a borrower owes money to a lender—whether it’s a personal loan, credit card dues, business loan, or home loan. Recovery is the process lenders use to collect that money when payments stop.

A loan defaulter is someone who fails to meet their contractual repayment obligations. This doesn’t make you a criminal—it’s a civil matter in most cases. However, defaulting does trigger a series of legal mechanisms that lenders can use to recover their dues.

Understanding what lenders can do—and what they cannot do—is crucial when you’re navigating financial stress.

Legal Actions Against Loan Defaulters in India

Indian law provides lenders with several avenues to recover outstanding debts. Here’s what the legal landscape looks like:

Legal Notice for Loan Default

This is always step one. Before any legal action begins, lenders must send you a formal legal notice. This document:

- States your outstanding debt amount clearly

- Requests repayment within a specific timeframe (usually 15-30 days)

- Warns of further legal action if you don’t respond

What most borrowers don’t realize: A legal notice isn’t a court order—it’s a warning. You still have time to respond, negotiate, or seek legal advice. Don’t panic and don’t ignore it.

Filing a Civil Lawsuit

If you don’t respond to the legal notice or refuse to cooperate, lenders can file a civil lawsuit in court. The lawsuit seeks a court order to recover the debt.

Key points:

- The suit is filed in the court where the lender or borrower resides

- Civil courts have broad powers and can order asset attachment

- Court proceedings can take months or even years

- Legal costs can add significantly to your total debt

The advantage for lenders? Civil courts offer more flexibility than specialized tribunals. For borrowers? This process gives you time to explore settlement options before any final judgment.

Debt Recovery Tribunal (DRT & DRAT)

Established under the Recovery of Debts Due to Banks and Financial Institutions Act, 1993, DRTs were created specifically to handle debt recovery cases faster than regular courts.

When DRT comes into play:

- Loans of ₹20 lakh or more (earlier it was ₹10 lakh)

- Debts owed to banks, financial institutions, and specified entities

- Cases involving secured or unsecured loans

The process:

- Lender files an application with the DRT

- DRT issues a summons to the borrower

- Both parties present their case

- DRT passes an order for recovery

Can you challenge DRT orders? Yes. You can appeal to the Debt Recovery Appellate Tribunal (DRAT), then to the High Court, and ultimately the Supreme Court if needed.

Borrower’s advantage: DRTs are meant to be faster than civil courts, but this also means less time to arrange repayment. Understanding the timeline helps you act quickly.

SARFAESI Act, 2002 – Explained Simply

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act is probably the most talked-about debt recovery law in India. Why? Because it allows banks to take possession of your secured assets without going to court.

But here’s what many borrowers don’t know—SARFAESI has specific conditions and protections.

Section 13(2): Demand Notice

When you default on a secured loan, the bank must first issue a demand notice under Section 13(2). This notice:

- Demands full repayment within 60 days

- Lists the secured assets (property, vehicle, etc.)

- Explains the consequences of non-payment

Section 13(4): Asset Possession

If you fail to repay within 60 days and don’t raise valid objections, the lender can:

- Take possession of the secured asset

- Sell the asset to recover dues

- Transfer the asset to themselves or another buyer

Can bank take property without court? Yes, under SARFAESI—but only for secured loans where you’ve pledged assets as collateral.

Borrower’s Right to Appeal

Here’s the protection: You have 45 days from receiving the Section 13(2) notice to file objections with the DRT. If you have valid grounds—like the debt amount is incorrect, or proper procedures weren’t followed—the DRT can stop the recovery process.

Important limitation: SARFAESI only applies to secured loans. For unsecured loans (personal loans, credit cards), lenders cannot use this act.

Insolvency and Bankruptcy Code (IBC), 2016

The IBC is typically used for corporate borrowers, but individual insolvency provisions exist too (though rarely used for small borrowers).

For corporate defaulters:

- Creditors can file an application with the National Company Law Tribunal (NCLT)

- This initiates the Corporate Insolvency Resolution Process (CIRP)

- The company gets 180 days (extendable to 270 days) to resolve insolvency

- If resolution fails, the company faces liquidation

What this means for individuals: If you’ve given a personal guarantee for a company loan, IBC proceedings against the company can affect you personally.

Arbitration Proceedings in Loan Recovery

If your loan agreement includes an arbitration clause, lenders can bypass courts entirely and opt for arbitration. This private dispute resolution process is:

- Faster than court litigation

- Less formal but legally binding

- Useful for both secured and unsecured loans

Lenders can even seek interim relief under Section 9 of the Arbitration & Conciliation Act, 1996, to freeze assets or prevent asset transfer while arbitration is ongoing.

Borrower’s perspective: Arbitration can actually work in your favor if you’re looking for a quicker, more confidential resolution compared to public court battles.

What Most Borrowers Don’t Know About Debt Recovery Laws

Here are the gaps in common knowledge that can cost you:

1. Recovery agents must follow RBI guidelines

The Reserve Bank of India has strict regulations on how recovery agents can behave. They cannot:

- Visit you between 7 PM and 7 AM

- Use physical violence or verbal abuse

- Contact your employer, relatives, or friends repeatedly

- Publicly shame you on social media or in your neighborhood

- Impersonate law enforcement

If recovery agents violate these rules, you can file a complaint with the Banking Ombudsman or even file an FIR.

2. Unsecured loans have limited recovery options

For unsecured loans (personal loans, credit cards), lenders cannot:

- Take your property under SARFAESI

- Directly seize any assets

- Force you into immediate bankruptcy

They must go through civil courts or DRT, which takes time and costs money. This gives you negotiating room.

3. Legal action takes time and money—for lenders too

Filing a lawsuit, engaging lawyers, attending tribunal hearings—these all cost money. For loans under ₹5 lakh, many lenders find it more economical to settle than to litigate for years.

4. A legal notice doesn’t mean you’ve lost

Many borrowers panic when they receive a legal notice and either ignore it or make desperate decisions. The truth? It’s just the starting point. You still have multiple opportunities to respond, negotiate, or seek professional help.

Debt Recovery Laws Are Powerful — But Not Unlimited

Yes, lenders have strong legal tools. But Indian law also protects borrowers from abuse and harassment. The system is designed to balance recovery rights with human dignity.

Court and tribunal actions take months, sometimes years. During this time, you have the opportunity to:

- Understand your exact liability

- Review your repayment capacity

- Explore legal settlement options

- Negotiate manageable repayment terms

Rushing into panic payments or ignoring the situation altogether are both mistakes. What you need is clarity and a plan.

How Borrowers Can Protect Themselves Legally

If you’re facing recovery pressure, here’s how to protect yourself:

1. Respond to legal notices immediately

Ignoring notices makes you look uncooperative and weakens your negotiating position. Acknowledge receipt and seek legal advice on how to respond.

2. Document everything

Keep records of:

- All loan agreements and sanction letters

- Payment receipts and bank statements

- Communication with the lender (emails, messages, call recordings if legal in your state)

- Any harassment or violations by recovery agents

3. Know your exact liability

Request a detailed statement showing:

- Principal amount outstanding

- Interest charged

- Penalties and fees

- Total amount due

Sometimes lenders inflate numbers. Verify everything.

4. Understand which law applies to your loan

- Secured loan + default = SARFAESI possible

- Unsecured loan = Civil suit or DRT (no asset seizure without court order)

- Loan above ₹20 lakh = DRT jurisdiction

Knowing this helps you anticipate the lender’s next move.

5. Explore legal ways to settle loan in India

Settlement is not the same as running away from debt. It’s a legal negotiation where:

- Lenders agree to accept less than the full amount

- You pay a lump sum or structured payment

- Both parties avoid lengthy court battles

Many borrowers don’t know that banks often prefer settlement over litigation—especially for unsecured loans.

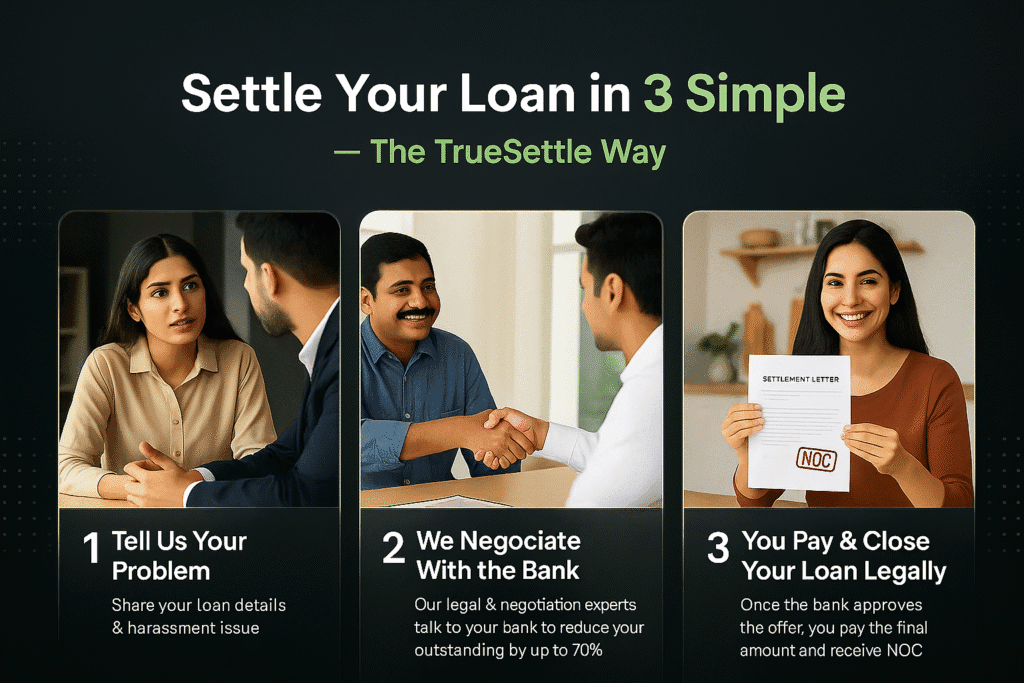

Role of TrueSettle in Handling Debt Recovery Situations

When you’re stuck between legal threats and financial inability, having someone who understands both sides makes all the difference.

TrueSettle works specifically with borrowers facing unsecured loan defaults—personal loans, credit cards, and other non-collateral debts. Here’s how they help:

Reviews legal notices and recovery threats: Not every threat is legally sound. TrueSettle helps you understand what’s real and what’s pressure tactics.

Explains borrower rights under SARFAESI, DRT, and IBC: Legal jargon is confusing. TrueSettle breaks down what each law means for your specific situation.

Negotiates pre-litigation settlements: Before things reach court, there’s often room to negotiate. TrueSettle engages with lenders on your behalf to work out manageable settlements.

Helps stop harassment legally: If recovery agents are violating RBI guidelines, TrueSettle guides you through the complaint process and ensures your rights are protected.

Focuses on unsecured loans only: This specialization means they understand the specific legal landscape and settlement possibilities for these types of debts.

The goal isn’t just to reduce your debt—it’s to help you understand your legal position, protect your rights, and find a sustainable path forward.

Conclusion: Legal Knowledge + Smart Settlement Wins

Debt recovery laws in India are comprehensive and powerful, but they’re not designed to destroy borrowers. The system provides multiple checkpoints, appeal options, and protections against abuse.

The real danger isn’t the law itself—it’s acting out of panic or ignorance. Whether you’re facing a legal notice, worried about asset seizure under SARFAESI, or simply unsure what happens next, understanding your legal rights is the first step toward regaining control.

If you’re facing legal notices or recovery pressure, remember this: understanding your rights before reacting can save you money, stress, and long-term financial damage. The law gives you time to respond thoughtfully—use it wisely.

Facing loan recovery pressure? Understanding your legal options is the first step to a smart resolution.

Need Help Understanding Your Situation?

If you’re dealing with unsecured loan recovery notices or harassment and need clarity on your rights and options, TrueSettle’s team can review your case. Get a free consultation to understand where you stand legally.