Facing a loan default situation can be overwhelming—whether you’re a lender seeking recovery or a borrower struggling with repayment. Understanding debt recovery laws in India is crucial for both parties to navigate this complex legal landscape effectively.

In this comprehensive guide, we’ll break down the legal actions against loan defaulters, the debt recovery process in India, and the rights available to all parties involved.

What is Debt Recovery? Understanding the Basics

Debt refers to any financial obligation or liability that a borrower owes to a lender. When a borrower fails to meet their contractual obligations to repay, they become a loan defaulter.

Debt recovery is the systematic process lenders use to retrieve outstanding debts from defaulters. This process ranges from informal reminders to formal legal proceedings, depending on the severity and duration of the default.

Legal Actions Against Loan Defaulters in India

India has established a robust framework of debt recovery laws to protect lenders’ interests while ensuring fair treatment of borrowers. Here are the primary legal remedies available:

Legal Notice Against Defaulters

The legal notice serves as the first formal step in the recovery of debts. This document:

- Informs the borrower about their outstanding debt amount

- Requests immediate repayment or acknowledgment

- Provides a specific timeframe (typically 15-30 days) for response

- Acts as a legal precursor to further action

Pro tip for borrowers: Ignoring a legal notice is never advisable. Responding promptly can help you negotiate better terms or explore settlement options.

Filing a Civil Lawsuit

When a borrower fails to respond to the legal notice, lenders can initiate civil lawsuit for loan recovery. Key advantages include:

- Wider jurisdiction: Civil courts have broader powers than specialized tribunals

- Flexible remedies: Courts can grant reliefs based on case-specific facts

- Comprehensive resolution: Addresses related disputes beyond just debt recovery

The lawsuit must be filed in the appropriate court based on jurisdiction—typically where the loan agreement was signed or where the borrower resides.

Recovery Tribunals (DRT & DRAT)

Established under the Recovery of Debts Due to Banks and Financial Institutions Act, 1993, Debt Recovery Tribunals (DRTs) offer a specialized, expeditious alternative to traditional courts.

Why DRTs Were Created

The mounting problem of Non-Performing Assets (NPAs) in India’s banking sector necessitated a faster mechanism for debt recovery. DRTs specifically handle:

- Loans and advances to banks and financial institutions

- Financial dues owed to entities under the RDDBFI Act

- Cases involving substantial debt amounts

The Appeal Process

- First Level: Debt Recovery Tribunal (DRT)

- Appeal Level: Debt Recovery Appellate Tribunal (DRAT)

- Further Appeals: High Court and Supreme Court of India

What borrowers should know: DRTs operate on stricter timelines than civil courts, so legal representation is crucial from the outset.

SARFAESI Act, 2002

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act revolutionized debt recovery by empowering lenders to recover secured debts without court intervention.

Section 13 of SARFAESI Act: The Game-Changer

This section outlines the step-by-step process for recovery:

Legal Demand Notice

- Banks issue a formal demand notice to the defaulter

- 60-day window provided for loan repayment

- Must clearly state the outstanding amount and consequences

Right to Appeal

- Borrowers can file objections with the DRT within 45 days of receiving the notice

- Valid grounds include procedural irregularities or dispute over debt amount

- This is a critical borrower protection mechanism

Possession of Secured Assets

If no repayment or valid objection occurs:

- Lenders can take possession of secured assets (property, vehicles, equipment)

- Assets can be sold or transferred to recover outstanding debt

- Must follow prescribed legal procedures

Borrower rights under SARFAESI Act: You cannot be forcibly evicted without proper notice. Know your rights to challenge unlawful possession.

Insolvency and Bankruptcy Code (IBC), 2016

The Insolvency and Bankruptcy Code 2016 provides a comprehensive framework for resolving corporate insolvency cases through the National Company Law Tribunal (NCLT).

Corporate Insolvency Resolution Process (CIRP)

For corporate loan defaulters, creditors can initiate CIRP by:

- Filing an application with NCLT

- Appointing an Insolvency Resolution Professional

- Attempting resolution within 180-330 days

- Liquidating assets if resolution fails

Key Objectives of IBC

- Time-bound resolution (faster than traditional litigation)

- Transparent proceedings

- Maximize asset value for all stakeholders

- Balance interests of debtors and creditors

Difference between DRT and NCLT: DRTs handle individual and smaller business debts, while NCLT focuses on corporate insolvency and restructuring.

Arbitration Proceedings

When loan agreements include an arbitration clause, lenders can opt for arbitration proceedings for loan recovery—often the fastest route to resolution.

Advantages of Arbitration in Debt Recovery

- Speed: Faster than court litigation

- Confidentiality: Private proceedings

- Enforceability: Arbitral awards are treated as court decrees

- Interim relief: Available under Section 9 of the Arbitration & Conciliation Act, 1996

This option is particularly valuable for commercial loans and high-value transactions where parties want to avoid lengthy court battles.

Borrower Rights and Protections

While legal action against loan defaulters is necessary for financial system stability, borrowers have important protections:

- Right to fair notice before asset seizure

- Right to challenge recovery proceedings in appropriate forums

- Protection from harassment by recovery agents

- Right to negotiate one-time settlements (OTS)

- Access to grievance redressal mechanisms

Facing recovery action? Seeking professional legal guidance early can help you explore debt restructuring, settlement, or other alternatives to protect your interests.

Frequently Asked Questions (FAQs)

What legal action can banks take against loan defaulters?

Banks can issue legal notices, file civil lawsuits, approach DRTs, invoke SARFAESI provisions to seize secured assets, initiate insolvency proceedings through NCLT, or pursue arbitration if the loan agreement includes such a clause.

How does the debt recovery process in India work?

The process typically follows these stages: 1) Initial reminders and notices, 2) Legal demand notice (60-day window), 3) Formal legal proceedings (DRT, civil court, or NCLT), 4) Asset seizure or court decree, 5) Recovery through sale or garnishment.

Can banks seize my property without court orders under SARFAESI Act?

Yes, for secured loans, banks can take possession of mortgaged property under SARFAESI Act Section 13 without court intervention—but only after proper legal notice and after the 60-day response period, provided you haven’t filed a valid objection with the DRT.

What is the difference between DRT and civil court for loan recovery?

DRTs are specialized tribunals for faster debt recovery with streamlined procedures, handling cases involving banks and financial institutions. Civil courts have wider jurisdiction and more flexible remedies but typically involve longer processing times.

How long does debt recovery take in India?

Timeline varies by method: SARFAESI can be completed in 4-6 months, DRT proceedings take 1-2 years, civil lawsuits may take 3-5 years, and IBC has a 180-330 day resolution window (though extensions occur).

What are my rights if I’m a loan defaulter?

You have the right to receive proper legal notices, challenge proceedings before DRT, negotiate settlement terms, seek debt restructuring, and protection from harassment. You can also approach consumer forums for grievances against unfair recovery practices.

Conclusion

The debt recovery laws in India provide a comprehensive framework that balances the interests of lenders seeking rightful recovery with the rights of borrowers facing genuine financial difficulties.

Whether you’re a lender navigating NPA recovery or a borrower dealing with default proceedings, understanding these legal mechanisms is essential. From legal notices and DRT proceedings to the SARFAESI Act and IBC, each remedy serves a specific purpose in the debt recovery ecosystem.

Need Expert Legal Guidance on Debt Recovery?

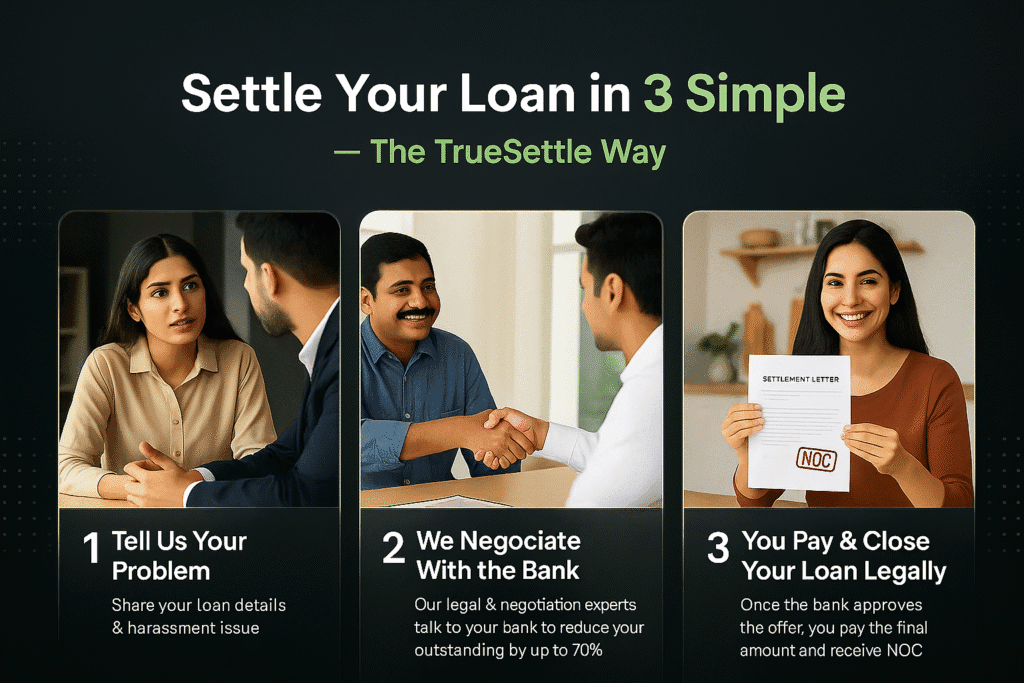

At TrueSettle, we specialize in debt resolution and recovery matters for both lenders and borrowers. Our experienced legal professionals can help you:

- Understand your rights and obligations

- Explore settlement and restructuring options

- Navigate complex recovery proceedings

- Protect your interests through proper legal representation

Contact TrueSettle today for a consultation and take the first step toward resolving your debt recovery concerns with confidence.

Disclaimer: This article provides general information about debt recovery laws in India and should not be construed as legal advice. For specific guidance on your situation, consult with a qualified legal professional.