When debt becomes unmanageable, finding a path to financial recovery becomes your priority. If you’re exploring loan settlement options in India, you’re likely searching for a loan settlement calculator India to estimate how much you might need to pay. While there isn’t a one-size-fits-all calculator due to varying lender policies and individual circumstances, understanding the settlement framework can help you approach negotiations with clarity and confidence.

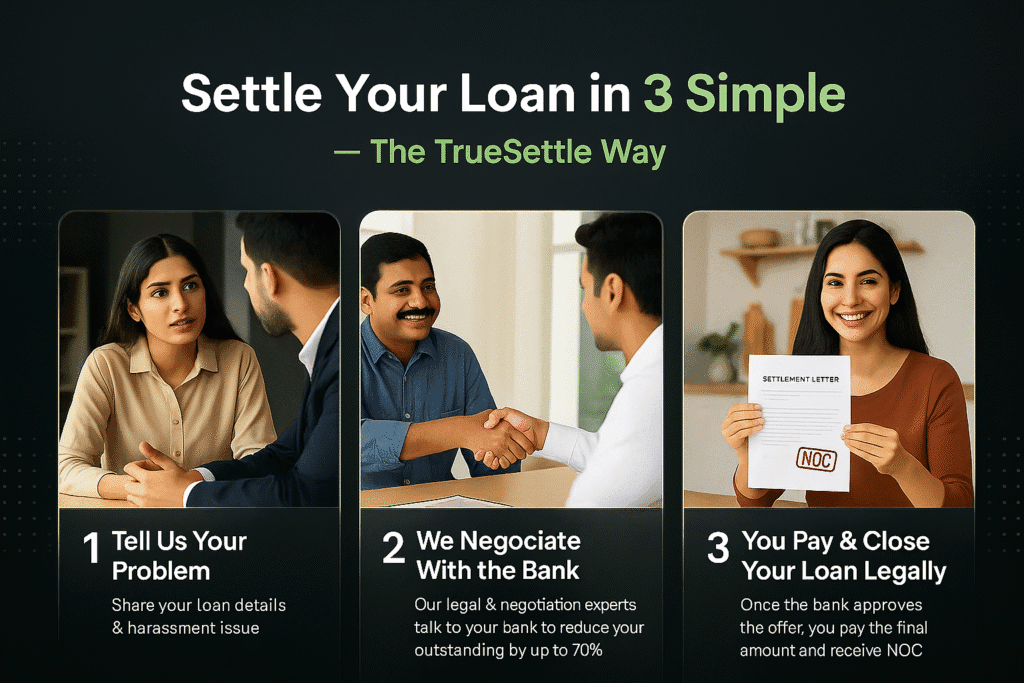

At Truesettle, we specialize in helping individuals and businesses navigate debt resolution strategically. This comprehensive guide will walk you through how loan settlement estimation works, what factors influence settlement amounts, and how you can build your own calculation framework.

What is a Loan Settlement Calculator?

A loan settlement calculator is a conceptual tool that helps you estimate the potential amount a lender might accept to close your outstanding debt for less than the full balance. Unlike EMI calculators that use fixed formulas, a personal loan settlement calculator must account for multiple variables including your financial hardship, loan type, outstanding amount, and lender flexibility.

The settlement process involves negotiating with your lender to accept a lump-sum payment that’s typically 30% to 70% of your total outstanding dues. The exact percentage depends on factors like whether it’s a credit card loan settlement calculator scenario or a secured mortgage loan settlement calculator situation.

Why Estimating Loan Settlement Matters

Understanding your potential loan settlement amount before negotiations gives you several advantages:

Financial Planning: Knowing the likely settlement range helps you arrange funds through savings, family support, or asset liquidation without overextending yourself.

Negotiation Power: When you walk into discussions with realistic expectations based on market standards, you negotiate from a position of knowledge rather than desperation.

Decision Making: Comparing the settlement lump sum against other options like debt restructuring or continued repayment helps you make informed choices about your financial future.

Credit Impact Awareness: Understanding that any settlement reflects as “settled” status on your CIBIL report allows you to weigh short-term relief against long-term creditworthiness implications.

How Loan Settlement Works in India

Loan settlement negotiation India follows a specific pattern. When borrowers face genuine financial hardship and cannot maintain EMI payments, lenders may prefer recovering a portion of the debt immediately rather than pursuing lengthy legal recovery processes.

The process typically unfolds in these stages:

The borrower defaults on payments or anticipates inability to repay, prompting them to contact the lender about settlement options. The lender assesses the borrower’s financial situation, repayment history, and the loan’s age. Based on internal policies and recovery prospects, the lender may propose a settlement percentage. Both parties negotiate the final amount and payment terms. Once agreed, the borrower pays the lump sum, and the lender provides a No Objection Certificate confirming the account closure.

Critical Understanding: Loan default India settlement opportunities increase as the account ages in the Non-Performing Asset category, typically after 90+ days of non-payment.

Loan Settlement Estimation Framework

While there’s no universal formula to calculate loan settlement amounts, you can build your estimation using this structured approach:

Step 1: Document Your Outstanding Amount

Obtain your current statement showing the complete picture: principal balance remaining, accumulated interest charges, penalty fees for late payments, and any legal or collection charges added. This total represents your starting point for the unsecured loan settlement India calculation.

Step 2: Evaluate Your Loan Category

Unsecured Loans (Personal loans, credit cards): These typically allow more flexible settlement percentage India outcomes, often 40-70% of outstanding dues, because the lender has no collateral to recover.

Secured Loans (Home loans, car loans): These settlements are more conservative, usually 60-90% of outstanding amounts, since the lender can seize and sell the asset if needed.

Step 3: Assess Settlement Influencing Factors

Your loan’s age and default duration significantly impact settlement possibilities. Accounts in the 90-180 day overdue range receive different treatment than those overdue beyond one year. Your previous repayment behavior matters—consistent defaulters may receive better settlement offers than those with strong track records who recently struggled.

Document your financial hardship with evidence like job loss letters, medical bills, business closure documents, or income reduction proof. Lenders evaluate hardship claims seriously when backed by documentation.

Step 4: Research Industry Settlement Ranges

Based on market practice across Indian financial institutions:

- Credit cards: 30-60% settlements are common for accounts 6+ months overdue

- Personal loans: 40-70% range depending on overdue period and lender policy

- Home/mortgage loans: 70-90% due to secured nature and legal complications

- Business loans: Highly variable, 40-80% based on business viability and guarantor involvement

Step 5: Determine Your Lump-Sum Capacity

Calculate realistically what you can pay immediately. Settlement requires one-time payment, so assess your liquid resources: savings and emergency funds, asset sale proceeds, family financial support, or borrowing from sources without EMI burden.

Your offer should be within the expected settlement range but leave room for negotiation. Starting at 40-45% when you can stretch to 55% gives you bargaining power.

Example: Personal Loan Settlement Calculation

Let’s walk through a practical scenario using a personal loan settlement calculator India framework:

Loan Details:

- Original loan: ₹8,00,000

- Outstanding principal: ₹6,50,000

- Accumulated interest: ₹1,20,000

- Penalties and charges: ₹30,000

- Total Outstanding: ₹8,00,000

Your Situation:

- Overdue for 7 months

- Previous good repayment history for 18 months

- Recent job loss with 60% income reduction

- Can arrange ₹4,00,000 lump sum

Settlement Estimation:

- Expected range: 40-65% = ₹3,20,000 to ₹5,20,000

- Your capacity: ₹4,00,000 (50% of outstanding)

- Opening offer: ₹3,50,000 (43.75%)

- Negotiation target: ₹4,00,000 (50%)

- Maximum stretch: ₹4,50,000 (56.25%)

This calculation gives you a realistic negotiation roadmap. You start lower, expect some back-and-forth, and know your absolute limit.

Credit Score Impact of Loan Settlement

Before pursuing settlement, understand the CIBIL after loan settlement implications:

Immediate Impact: Your account will be marked as “Settled” rather than “Closed,” which indicates you didn’t pay the full amount. This status typically reduces your credit score by 75-100 points initially.

Long-term Consequences: The “settled” status remains visible for 7 years from the settlement date. Future lenders view settled accounts cautiously, potentially affecting your ability to secure loans, credit cards, or even rental agreements.

Recovery Path: While settlement impacts your score, it’s better than continued default. You can rebuild credit through secured cards, small consumer durables loans, and consistent financial behavior over 18-24 months.

Alternative Consideration: If your score is already low due to defaults, settlement might actually help by closing the problematic account and stopping additional interest and penalties from accruing.

Loan Settlement Negotiation Tips

Successful loan settlement amount negotiations require strategy:

Timing Matters: Approach settlement discussions before legal action begins. Once cases reach court, settlement becomes more difficult and expensive.

Written Communication: Document all communication. Email and letters create paper trails that protect you if disputes arise later.

Professional Representation: Consider working with debt resolution India specialists like Truesettle who understand lender psychology and negotiation tactics. Professional negotiators often secure better terms than individual attempts.

Lump-Sum Readiness: Never negotiate without having funds ready. Lenders are more flexible when they know you can pay immediately.

Get It in Writing: Before paying anything, obtain written confirmation of the settlement terms, the final amount, payment deadline, and commitment to issue an NOC and update credit bureaus.

Avoid Repeated EMI Defaults: If you cannot pay the settlement lump sum immediately, discuss structured settlement options rather than promising lump sums you cannot deliver.

Should You Use a Loan Settlement Calculator?

While automated tools claiming to calculate exact settlement amounts exist, treat them with caution. True how to calculate loan settlement amounts requires human evaluation of your specific circumstances and lender policies that change regularly.

When Estimation Tools Help:

- Understanding ballpark settlement ranges

- Comparing settlements across different loan types

- Initial financial planning before lender contact

- Educational purposes to understand the concept

When You Need Professional Help:

- Multiple loans requiring coordinated settlement strategy

- Legal notices already received from lenders

- Confusion about documentation and process

- Need for representation in difficult negotiations

At Truesettle, we don’t offer oversimplified calculators because we believe your financial situation deserves personalized analysis. Our legal and financial experts evaluate your complete debt portfolio, income situation, and goals to develop customized settlement strategies.

Final Thoughts

Navigating loan settlement requires understanding that there’s no perfect loan settlement calculator India that accounts for every variable. However, armed with the framework outlined here, you can estimate potential settlement ranges, prepare financially, and approach negotiations strategically.

Remember that settlement is a serious financial decision with lasting credit implications. While it provides immediate relief from overwhelming debt, consider all alternatives including debt restructuring, consolidation, or extended repayment plans before committing to settlement.

Ready to explore your options? Truesettle’s experienced team has successfully negotiated settlements across personal loans, credit cards, business loans, and mortgage situations. We combine legal expertise with financial strategy to help you achieve the best possible outcome while minimizing credit impact.

Contact Truesettle today for a confidential consultation about your debt situation. Let us help you move from financial stress to stability with a clear, actionable settlement strategy.

Frequently Asked Questions

Q: What percentage can I settle my loan for in India?

Settlement percentages typically range from 30-70% of the outstanding amount depending on loan type and circumstances. Unsecured loans like personal loans and credit cards generally settle at 40-60%, while secured loans settle higher at 60-90% due to collateral involvement.

Q: Will loan settlement affect my CIBIL score?

Yes, loan settlements are reported as “settled” status on your CIBIL report, which negatively impacts your credit score. The settled status remains visible for 7 years and may affect future loan approvals, though it’s still better than continued default.

Q: Can I negotiate loan settlement directly with my bank?

Yes, you can negotiate directly with your lender. However, working with debt resolution India professionals like Truesettle often results in better settlement terms because experts understand lender policies and negotiation strategies.

Q: When is the best time to request loan settlement?

The ideal window is typically 90-180 days after default, when your account is classified as NPA but before legal proceedings begin. However, settlements can occur at various stages depending on your situation and lender flexibility.

Q: Do I need to pay the settlement amount all at once?

Most lenders require lump-sum payment for settlements. However, some may accept structured settlement payments over 2-3 installments in specific cases. Discuss payment options during negotiations.

Q: What documents do I need for loan settlement negotiation?

Typically, you’ll need your loan statements, identity proof, income documentation, and hardship evidence such as medical bills, termination letters, or business closure documents. Having comprehensive documentation strengthens your negotiation position.

Q: Is loan settlement better than loan foreclosure?

Foreclosure means paying the full outstanding amount and closing the loan early, which doesn’t hurt your credit score. Settlement means paying less than the full amount, which does impact your score. Choose settlement only if you cannot afford full repayment.

Q: Can settled loans be reopened by the lender?

No, once you have a proper settlement agreement and No Objection Certificate from the lender, the account cannot be reopened. This is why getting written confirmation is crucial before making any settlement payment.

About Truesettle: We are a leading legal and financial advisory firm specializing in debt resolution, loan settlement negotiation, and credit recovery strategies across India. Our expert team helps individuals and businesses navigate financial challenges with customized solutions that prioritize both immediate relief and long-term financial health.

Disclaimer: This article provides general information about loan settlement practices in India and should not be considered legal or financial advice. Settlement terms vary by lender and individual circumstances. Consult with qualified professionals before making settlement decisions.