Receiving threatening calls from recovery agents at odd hours? Charged penalties you never agreed to? If your bank has crossed the line from service provider to source of stress, you’re not alone—and you’re not powerless.

Every year, thousands of Indians face unethical bank practices, from recovery agent harassment to hidden charges. The good news? India has a robust grievance redressal framework that protects your rights. This guide walks you through exactly how to file a complaint against bank harassment, unfair charges, and other violations—step by step.

Recognizing Unethical Bank Practices: Know Your Rights First

Before you file a complaint against bank misconduct, identify what you’re dealing with. Common unethical bank practices include:

Recovery Agent Violations

- Harassment through abusive language, threats, or calls to your workplace

- Public disclosure of your debt to family, friends, or colleagues

- Visits outside permitted hours (before 7 AM or after 7 PM)

Financial Misconduct

- Hidden fees and penalty charges not disclosed in your agreement

- Unauthorized changes to loan terms without written notice

- Misleading information about interest rates or repayment schedules

Service Failures

- Discriminatory lending based on gender, religion, or background

- Unauthorized transactions on your account

- Persistent delays in processing legitimate requests

Recognizing the problem is step one. Taking action is step two.

Step 1: Start with Your Bank’s Grievance Redressal System

RBI guidelines mandate that every bank maintain an internal complaint mechanism. Here’s how to use it effectively:

Contact Customer Service First

Call or visit your branch and clearly state your complaint. Document everything:

- Date and time of contact

- Name of the representative

- Reference number provided

- Summary of their response

Pro tip: Don’t vent—state facts. “Your recovery agent called my employer on [date]” is more effective than “You’re harassing me.”

Escalate with a Written Complaint

If verbal communication fails, write a formal complaint. A written complaint creates a legal record and triggers the bank’s 30-day resolution timeline under RBI bank complaint guidelines.

Your complaint should include:

- Your contact details and account/loan number

- Chronological description of the issue

- Supporting documents (screenshots, bank statements, emails)

- Specific resolution you’re seeking

Sample Complaint Format Against Bank (Copy-Ready Template)

[Your Name]

[Address]

[City, PIN Code]

[Phone Number]

[Email Address]

Date: [DD/MM/YYYY]

To,

The Branch Manager / Grievance Redressal Officer

[Bank Name]

[Branch Address]

Subject: Formal Complaint Against [specify: Recovery Agent Harassment / Unfair Charges / etc.]

Dear Sir/Madam,

I am writing to file a formal complaint regarding [brief issue—e.g., harassment by recovery agents assigned to my loan account].

ACCOUNT DETAILS:

- Account/Loan Number: [Number]

- Branch: [Branch Name]

COMPLAINT DETAILS:

On [date], I experienced [describe the incident—e.g., I received threatening calls from a person claiming to represent your bank's recovery department. The caller used abusive language and disclosed my personal financial information to my colleagues at work].

PREVIOUS ATTEMPTS TO RESOLVE:

I contacted your customer service on [date] (Reference No: [if any]), but the issue remains unresolved.

SUPPORTING EVIDENCE:

Enclosed are [list documents—e.g., call recordings, screenshots of messages, witness statements].

RESOLUTION SOUGHT:

I request that you [be specific—e.g., immediately cease all contact from this recovery agent, issue a written apology, and reverse the Rs. [amount] in unauthorized charges].

As per RBI guidelines, I expect a resolution within 30 days. Please acknowledge receipt of this complaint and provide updates on the progress.

Sincerely,

[Your Signature]

[Your Name]

Important: Banks must acknowledge your complaint and resolve it within 30 days. If they don’t, you have grounds to escalate.

💡 Facing aggressive recovery tactics? Learn your legal rights first. TrueSettle’s experts can assess your situation and recommend the fastest path to relief—Get Your Free Harassment Assessment

Step 2: Escalate to the Banking Ombudsman

If 30 days pass with no resolution—or if the bank’s response is unsatisfactory—your next stop is the Banking Ombudsman. This is where the banking ombudsman complaint process becomes your strongest weapon.

What is the Banking Ombudsman?

The Banking Ombudsman is a quasi-judicial authority appointed by RBI to resolve customer complaints. The best part? Their decisions are legally binding on banks, and the service is completely free.

How to File a Banking Ombudsman Complaint Online

Option 1: Online Complaint (Fastest)

- Visit the RBI Complaint Management System

- Select “Lodge a Complaint”

- Choose your bank and region

- Fill in complaint details with your bank’s complaint reference number

- Upload supporting documents

- Submit and note your complaint registration number

Option 2: Written Complaint Send a detailed letter to the Banking Ombudsman of your region (find addresses on the RBI website). Include:

- Your original complaint to the bank

- Bank’s response (or lack thereof)

- All supporting documents

- Desired outcome

Banking Ombudsman Complaint Timeline

- Acknowledgment: Within 7 days

- Resolution: 1-2 months for standard cases

- Appeal: If unsatisfied, you can appeal to RBI’s Appellate Authority within 30 days

Pro insight: The Ombudsman can award compensation up to Rs. 20 lakh for customer loss or harassment. Document everything to strengthen your case.

Step 3: File an RBI Bank Complaint for Systemic Issues

While the Banking Ombudsman handles individual complaints, you can report serious violations directly to RBI’s Consumer Protection Department. This is crucial for:

- Repeated violations by the same bank

- Patterns of unethical bank practices affecting multiple customers

- Non-compliance with RBI guidelines on recovery agents

How to Escalate Bank Complaint to RBI

- Visit RBI’s Complaint Portal

- Navigate to “File a Complaint” under Consumer Protection

- Provide details of your complaint and previous escalation attempts

- Submit online or send by post to:

Reserve Bank of India

Consumer Education and Protection Department

Central Office, Mumbai – 400001

Reality check: RBI doesn’t resolve individual disputes but can investigate the bank for regulatory violations, which often prompts faster action on your case.

⚖️ Complaint not working? Sometimes settlement is faster than legal battles. TrueSettle’s negotiators have resolved over 8500+ cases—Explore Your Settlement Options

Step 4: Legal Action Against Bank Harassment (When Nothing Else Works)

If internal complaints, the Ombudsman, and RBI escalation fail, you have legal recourse:

Consumer Court Complaint Against Bank

File under the Consumer Protection Act for:

- Deficiency in service

- Unfair trade practices

- Mental agony and harassment

Jurisdiction:

- Up to Rs. 50 lakh: District Consumer Commission

- Rs. 50 lakh – Rs. 2 crore: State Consumer Commission

- Above Rs. 2 crore: National Consumer Commission

Cost: Minimal court fees; you can file without a lawyer for amounts under Rs. 10 lakh.

Civil or Criminal Action

For severe cases involving:

- Fraud or cheating (IPC Section 420)

- Criminal intimidation (IPC Section 506)

- Extortion (IPC Section 384)

Consult a lawyer and file an FIR at your local police station.

Your Rights Under RBI Guidelines on Bank Complaints

Understanding RBI consumer protection banking rules strengthens your position:

RBI Guidelines on Recovery Agents

- No calls before 7 AM or after 7 PM

- No contact with third parties (employers, relatives) without borrower consent

- No threatening language or physical intimidation

- Banks must provide written notice before initiating recovery

Violation = Grounds for complaint + potential compensation.

Bank’s Timeline to Resolve Complaints

- Branch level: 7 days

- Escalation level: 30 days from complaint receipt

- Failure to respond: Automatic grounds for Ombudsman complaint

FAQs: Filing Complaints Against Bank Harassment

Q: How long does a bank have to resolve a complaint?

A: Banks must resolve complaints within 30 days of receipt. If they don’t respond or you’re unsatisfied with the response, you can immediately escalate to the Banking Ombudsman.

Q: Can I complain directly to RBI without going to the bank first?

A: For individual complaints, you must first approach your bank and wait 30 days. However, you can report systemic violations or non-compliance with banking regulations directly to RBI at any time.

Q: What if the Banking Ombudsman rejects my complaint?

A: You can appeal to the RBI’s Appellate Authority within 30 days. If the Ombudsman finds your complaint outside their jurisdiction, you can still pursue legal action through consumer court.

Q: Is recovery agent harassment illegal in India?

A: Yes. RBI guidelines strictly prohibit harassment, threats, or contact outside permitted hours. Document every violation—you can file complaints with the bank, Banking Ombudsman, and even register an FIR for criminal intimidation.

Q: How do I prove bank harassment?

A: Keep detailed records:

- Call recordings and timestamps

- Screenshots of abusive messages

- Witness statements from people present during harassment

- Written communications from the bank or recovery agents

Q: Can I get compensation for bank harassment?

A: Yes. The Banking Ombudsman can award up to Rs. 20 lakh for loss suffered or harassment. Consumer courts can award higher amounts based on your case.

Q: What happens if I ignore bank recovery calls?

A: Ignoring calls won’t make the debt disappear, but you don’t have to tolerate harassment. File a complaint against recovery agents while simultaneously exploring settlement options to resolve the underlying debt.

Don’t Fight Alone: When Expert Help Makes All the Difference

Filing complaints is your right, but it’s not always the fastest path to relief. Here’s the reality: the complaint-to-resolution process can take 2-6 months. Meanwhile, harassment continues, interest compounds, and stress builds.

That’s where settlement becomes strategic.

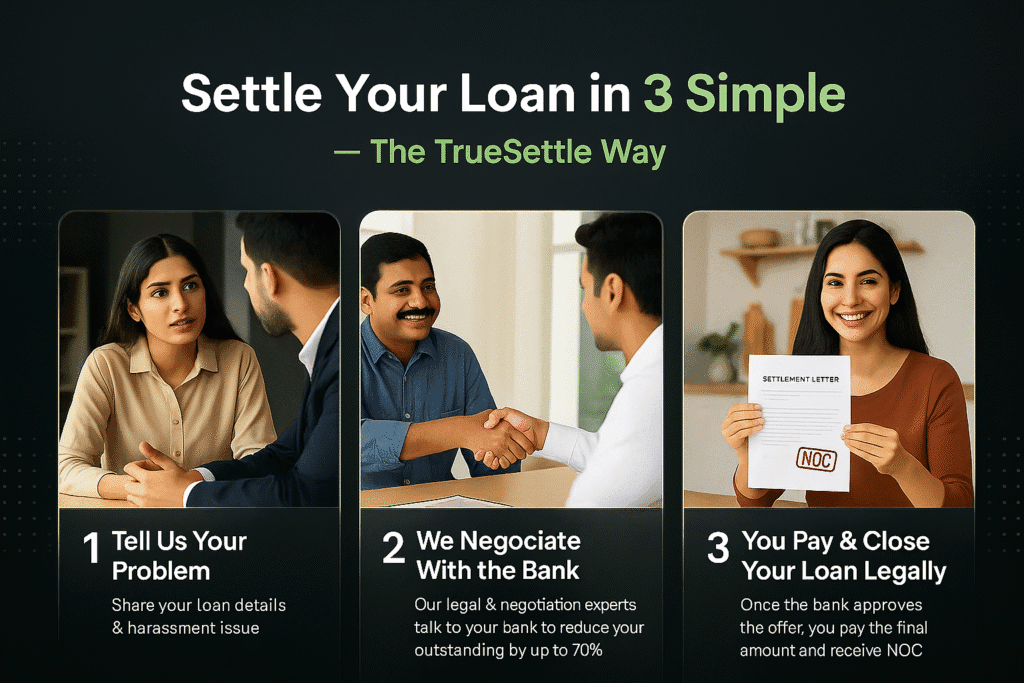

At TrueSettle, we’ve helped hundreds of clients resolve bank disputes without the long wait of legal proceedings. Our approach:

✅ Immediate Relief: We negotiate directly with banks to stop harassment while your case is active

✅ Debt Resolution: Reduce your outstanding amount through professional settlement negotiation

✅ Legal Shield: Our legal experts can file complaints on your behalf while we work on settlement

✅ End-to-End Support: From first complaint to final closure—we handle it all

The best part? Most banks prefer settlement over lengthy complaint processes. We leverage that to get you better terms, faster.

Take Action Today: Your Next Steps

If you’re dealing with unethical bank practices, here’s what to do right now:

- Document everything: Start your evidence file today

- File a written complaint: Use our template above

- Set a 30-day reminder: If unresolved, escalate immediately

- Explore settlement: While complaints work through channels, settlement can offer faster relief

Remember: You don’t have to accept harassment, hidden charges, or unfair treatment. The law is on your side, and help is available.

Ready to End the Harassment?

Free Consultation: Share your situation with TrueSettle’s experts. We’ll assess your case and outline your best path forward—whether that’s complaints, settlement, or legal action.

📞 Contact TrueSettle Today: www.TrueSettle.in

Because financial freedom shouldn’t require fighting alone.